The point of the American Recovery and Reinvestment Act was to encourage national economic growth. The point was to curb unemployment. The point was to help small businesses be what D.C. has forever claimed they are—the national economic backbone. The point was to stimulate the economy… not the federal government.

But that’s what we’ve got. A federal government stimulated and growing by the day.

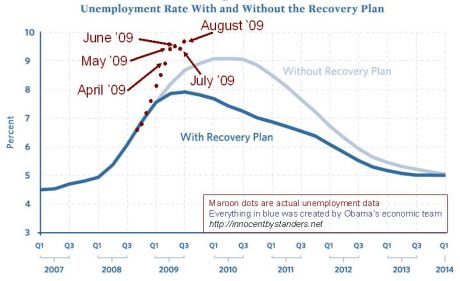

The Recovery Act was doomed from the start. Increasing spending while cutting taxes is a great way to grow a deficit and create future economic problems, not save an economy. The stimulus money never really had a shot at creating 3 million jobs, as was promised, and have them be sustainable. But the stimulus is failing even by the flawed standards of its creators!

With national unemployment at 9.7%, the USA Today reported Thursday morning that the number of civilian workers in federal government has increased by 25,000 since December of 2008:

Fourteen of the top federal agencies responsible for spending under the American Recovery and Reinvestment Act say they’ve hired about 3,000 workers with stimulus money. That’s helped fuel the continued growth of the federal government, which increased by more than 25,000 employees, or 1.3%, since December 2008, according to the latest quarterly report. During that time, the ranks of the nation’s unemployed increased by nearly 4 million, Labor Department statistics show. Overall, there are about 2 million federal workers, the data show.

Thirteen agencies that report stimulus-related administrative expenses separately on their weekly spending reports say they’ve spent $186.8 million so far on salaries and other overhead. Those agencies have reported spending $46.1 billion in stimulus funds overall.

This growth in civilian federal employment stands in sharp contrast with the rise in national unemployment during the same period. In December 2008, unemployment was 7.2%, but it has now climbed to 9.7%, a growth rate of 35%. Recall that White House economic advisors led by Christina Romer argued in January that, without the Recovery plan, unemployment would skyrocket all the way up to 9% by January 2010. But, they promised, the stimulus money would make unemployment peak at 8% in September 2009 and then march downwards. The real September unemployment numbers brought a resounding collective “oops” at 1600 Pennsylvania Ave.

Now, it could be argued that unemployment would be higher if Uncle Sam didn’t employ all those government workers. But I would counter that if all of the money spent by the feds had remained in the private sector, then more jobs would have been created.

Consider the massive pay gap between federal workers and the civilian population. Chris Edwards at CATO ran the most recent numbers last month, and put together this chart showing federal worker compensation now averages $119,982, more than double the private sector average of $59,909.

Again, there is a plausible argument against my position. Many of the jobs the federal government hires workers for are naturally higher paying jobs. There are many security personnel and technical workers in the federal government and not as many minimum wage level jobs. But this doesn’t account for the degree of discrepancy in pay. In fact, wages have climbed so high that even President Obama has called for a cap on federal pay raises.

Furthermore, money spent by the government on a worker is not the same as money spent by the private sector on a worker. Not only does the money go twice as far to pay compensation in the private sector (on average), but the production of private sector employees creates exponential value that government employees can’t make.

In the private sector, the money a firm uses to pay an employee is more than just a salary and benefits. In most cases, the firm is paying for the skills and ideas of that worker to generate growth. That growth, measured in terms of profits, leads to the need and capacity to hire more workers. This is the value of encouraging private sector employment growth instead of just expanding the size of government.

Check out Reason’s Taxpayer’s Guide to the Stimulus for more information on where all the Recovery money is going.

This was originally posted at BigGovernment.com.