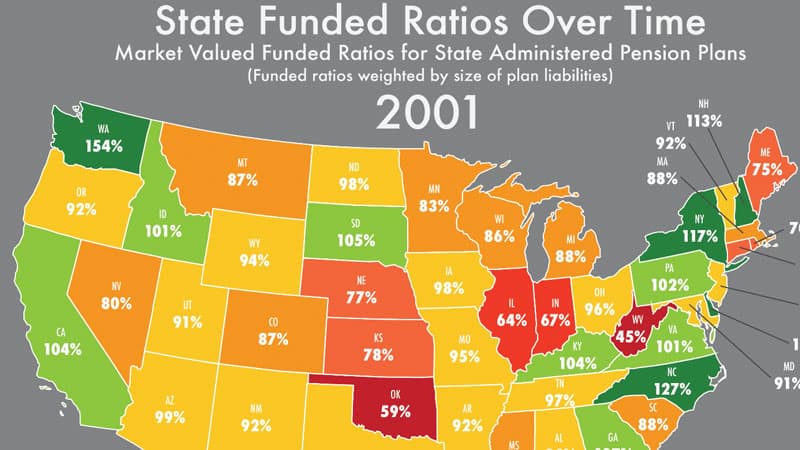

Measuring state funded ratios for their pension plans can sometimes provide too narrow of a picture of fiscal health when the focus is just on one year. However, looking at the funded ratio data over time can provide a clearer, contextualized picture for the evolution of the solvency state defined benefit plans.

To this end, my colleagues Zach Christensen and Anil Niraula have helped to create a new visualization of the funded ratio for the 50 states and their pension plans over the past 15 years. The 2001 to 2016 data provides a dynamic way to watch trends for pension plans.

One of the most notable trends is the sharp drop in funded ratios during the financial crisis, largely reflected in 2008 and 2009 data. While several states enjoyed full funding in previous years, all states had fallen below 100% by 2009 and only two states (Washington and Wisconsin) could claim funding above 90%.

Another trend is a brief improvement in funded status following 2009, but a general leveling out of funded ratios since then and even a general decline into 2016. This reflects the slow rate of recovery since the financial crisis and the underlying fact that more is going on with pension underfunding than just the financial crisis hit on assets. The vast majority of pension plans have reported strong investment returns for fiscal year end dates in 2017, suggesting there will be a slight uptick with these ratios for next year.

A final trend of note is how states have recovered better than others after 2009. Oklahoma, Nebraska, West Virginia, Maine, South Dakota and Tennessee all saw improvements of over 20 percentage points in their funding from 2009 to 2016. Other states saw little to no improvements over that timeframe. A few states (Illinois, Washington, Massachusetts, Wyoming, Kentucky, Connecticut, Colorado, and Pennsylvania) actually have lower funded ratios in 2016 than they had in 2009. Pennsylvania’s ratio dropped the most, going from 61% in 2009 to 52% in 2016. A decreasing funded ratio amidst recovering market conditions ought to raise alarms for those states’ policymakers and taxpayers alike.

See the full methodology on the data visualization here.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.