The White House Office of Management and Budget’s Office of Information and Regulatory Affairs (OIRA) finally published on Dec. 6 the Fall 2023 edition of the Unified Agenda of Regulatory and Deregulatory Actions that had been due in October. The Unified Agenda is the biannual snapshot of the federal administrative state and tracks the thousands of regulatory actions across hundreds of agencies. While imperfect in many ways, it provides valuable insight into forthcoming federal agency actions.

The Fall 2023 edition marks the first Unified Agenda publication to incorporate the regulatory review changes mandated by Executive Order 14094, which President Joe Biden signed on April 6. It also includes a new proposed rule from the Federal Highway Administration that could needlessly increase state highway construction costs.

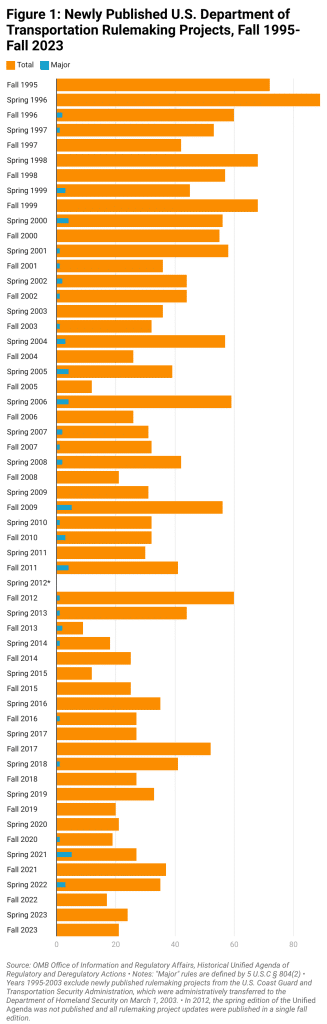

I previously examined the transportation rulemakings in the Spring 2023, Fall 2022, Spring 2022, Fall 2021, Spring 2021, and Spring 2020 editions of the Unified Agenda for Reason Foundation. From a historical perspective, Figure 1 below shows the current volume of regulatory activity at the United States Department of Transportation is typical of what has been observed since the Obama administration.

The Fall 2023 Unified Agenda lists 241 active rulemaking projects at the US Department of Transportation. Of those 241, 21 are new rulemaking projects first published in the Fall 2023 edition. These new rulemaking projects are listed in Table 1 at the bottom of this article.

The Unified Agenda contains rules determined to be “significant regulatory actions” or “economically significant” rules, which had been defined by Executive Order (EO) 12866 (1993) as regulations that would have an annual impact on the economy of $100 million or more, or otherwise “adversely affect in a material way the economy, a sector of the economy, productivity, competition, jobs, the environment, public health or safety, or State, local, or tribal governments or communities.” Rules deemed economically significant are subject to greater scrutiny, most notably a requirement that agencies conduct a benefit-cost analysis of the proposed regulation.

With Executive Order 14094 (2023), the annual cost threshold for a rule to be considered a “significant regulatory action” doubled to $200 million, and that threshold will be adjusted every three years for “changes in gross domestic product.”

Supporters of this change argued it was necessary to control for economic growth and ensure rules deemed “significant” are actually significant to the economy. But it also means fewer rules will face heightened regulatory impact analysis, and those who believed that too few rules faced robust benefit-cost analysis under the previous cost threshold view this change as a reduction in regulatory transparency. Along with other provisions in EO 14094, Congress or subsequent administrations may consider reversing this change in regulatory review policy.

Relevant for historical accounting purposes, the traditional Office of Information and Regulatory Affairs rulemaking project designation of “economically significant” has been retired in favor of the impressively anodyne “section 3(f)(1) significant,” which references the definition of “significant regulatory action” in EO 12866. While the increased annual cost threshold for economically significant rules may be defensible, it makes like-for-like comparisons over time more difficult.

Fortunately, as part of the Congressional Review Act, Congress itself requires a separate “major” rule designation that retains the traditional $100 million threshold (5 USC § 804(2)(A)), allowing for continued like-for-like historical accounting. (Going forward, Figure 1 will preserve the traditional cost threshold by counting “major” rules instead of “section 3(f)(1) significant” rules.) For comparison, there are currently 16 “major” rules and 12 “section 3(f)(1)” rules under development at the Department of Transportation.

Perhaps the most consequential newly announced rulemaking project in the Fall 2023 Unified Agenda is the Federal Highway Administration’s (FHWA) Application of Buy America to Manufactured Products proposed rule, which was submitted to OIRA review on Dec. 12, 2023, and is scheduled to be published in April 2024. Until the proposal is published, we cannot gauge likely impacts. That being said, if the rule is expansive in scope, it is likely to impose significant new construction costs on state departments of transportation.

Since the Carter administration, Congress has imposed “Buy America” domestic procurement requirements on state highway projects receiving federal funding. Section 401 of the Surface Transportation Assistance Act of 1978 required recipients of federal-aid highway funding to use steel, iron, and manufactured products produced in the United States. But in FHWA’s 1978 implementing regulations, it also provided a general waiver from Buy America requirements “to products and materials, other than structural steel, used in highway construction.”

Congress subsequently fine-tuned FHWA’s Buy America requirements and the agency’s 1983 implementing regulation maintained the general waiver for manufactured products. In doing so, FHWA agreed that it was “very difficult to identify the various materials and then trace their origin” in complex manufactured products, “such as a traffic controller which has many components.” Enforcement against unfair trade practices involving manufactured products was seen as a task better suited for trade authorities, not the transportation planners and engineers who staff FHWA and state highway departments. This general waiver has remained in place ever since.

Labor unions and some domestic manufacturers have long opposed the general waiver on protectionist grounds. The anti-trade lobby scored a significant win with the Infrastructure Investment and Jobs Act of 2021, which included the Build America, Buy America Act (BABA). BABA expressed a general policy preference against any “waiver of general applicability not limited to the use of specific products for use in a specific project.”

The Biden administration has been eager to leverage BABA to expand Buy America protectionism into new domains, thus the new proposed rule. This is especially unfortunate for state transportation agencies, which have seen highway construction costs increase by 50% over the last two years. President Biden and members of Congress have touted the historic $92.3 billion increase in highway spending over FY 2022-2027 that was included as part of the $1.2 trillion Infrastructure Investment and Jobs Act. Unfortunately, it is increasingly likely that inflation will wipe out the entirety of that funding increase. New Buy America requirements on manufactured products will make this problem even worse.

OIRA currently lists the impact of this rule as “undetermined,” which suggests the scope of the final rule will determine whether annual costs reach $100 million “major” status or $200 million “3(f)(1) significant” status. To reduce regulatory costs, FHWA could choose to combine any narrowing or repeal of the general waiver for manufactured products with a more robust and permissive product-specific waiver process.

Policymakers should understand that in the real world of budget constraints, federally mandated cost increases necessarily translate to fewer transportation projects and reduced benefits for Americans who would enjoy them. The best option would be for Congress to reconsider BABA and instead codify a general manufactured products waiver. This would reduce uncertainty and avoid the necessary cost increases associated with the most “significant” interpretation of BABA’s application to manufactured products.

Table 1: US Department of Transportation Rulemaking Projects First Published in the Fall 2023 Unified Agenda

| Agency | Stage of Rulemaking | Title | RIN |

|---|---|---|---|

| OST | Proposed Rule | Transportation Priorities and Allocations System | 2105-AF21 |

| FAA | Proposed Rule | Foreign Air Operator Certificates Issued by a Regional Safety Oversight Organization | 2120-AL93 |

| FAA | Proposed Rule | Equipment, Systems, and Network Information Security Protection | 2120-AL94 |

| FAA | Final Rule | Removal of the Prohibition Against Certain Flights in Specified Areas of the Dnipro Flight Information Region (FIR) (UKDV) | 2120-AL95 |

| FHWA | Proposed Rule | Consultant Services | 2125-AG12 |

| FHWA | Proposed Rule | Application of Buy America to Manufactured Products | 2125-AG13 |

| FHWA | Final Rule | Update to National Electric Vehicle Infrastructure Standards and Requirements | 2125-AG14 |

| FMCSA | Prerule | Minimum Training Requirements for Entry-Level Commercial Motor Vehicle Operators; Additional Curriculum and Training Provider Requirements | 2126-AC71 |

| FMCSA | Proposed Rule | Incorporation by Reference; North American Standard Out-of-Service Criteria; Hazardous Materials Safety Permits | 2126-AC65 |

| FMCSA | Proposed Rule | Fees for the Unified Carrier Registration Plan and Agreement | 2126-AC67 |

| FMCSA | Proposed Rule | Commercial Driver's License Standards; Incorporation by Reference of a New State Procedures Manual | 2126-AC68 |

| FMCSA | Proposed Rule | Commercial Motor Vehicle Drivers Qualifications; Seizure Standard | 2126-AC69 |

| FMCSA | Proposed Rule | National Registry of Certified Medical Examiners; Administrative Removal of Medical Examiners | 2126-AC70 |

| FMCSA | Final Rule | General Technical Amendments | 2126-AC66 |

| NHTSA | Proposed Rule | Update to the Procedures for Securing Child Restraints under FMVSS No. 213 and Qualification Tests for the Hybrid III 3-year-old test dummy under Part 572 | 2127-AM62 |

| FRA | Proposed Rule | Positive Train Control Systems | 2130-AC95 |

| FTA | Proposed Rule | Transit Worker and Public Safety | 2132-AB47 |

| SLSDC | Prerule | Seaway Regulations and Rules: Periodic Update, Various Categories | 2135-AA55 |

| SLSDC | Prerule | Tariff of Tolls | 2135-AA56 |

| PHMSA | Proposed Rule | Hazardous Materials: Harmonization With International Standards | 2137-AF64 |

| PHMSA | Proposed Rule | Hazardous Materials: Enhancing Safety for High-Hazard Trains (HHTs) | 2137-AF65 |