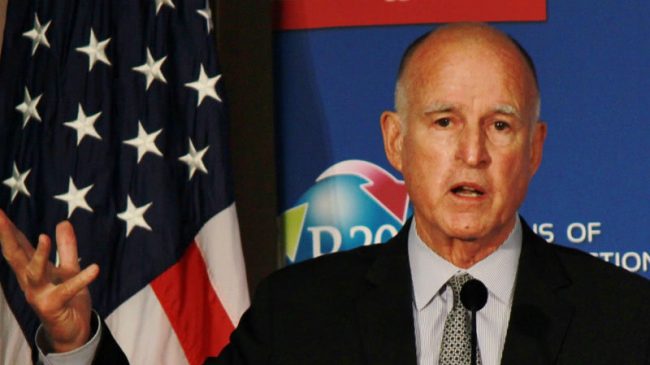

Gov. Jerry Brown has been sounding a fiscal warning, noting that, despite California’s current budget surplus, “the next recession is getting closer, and the state must begin to plan for it.”

Rather than recklessly assuming California will experience ever-growing revenue and spending, as many of his predecessors did, Gov. Brown is pointing to financial projections from the Department of Finance that estimate the next recession, even if moderate in intensity, would slash state revenue by $55 billion over three years.

To help prepare for potential economic downturns, Brown is calling for a $2 billion deposit in the state’s rainy day fund and prefunding retiree health care benefits to start eliminating the current $72 billion in unfunded liabilities.

While these proposals are a good start, he should also look to Utah’s recent innovations showing how to take fiscal preparedness planning to the next level.

The business news site Government Executive recently highlighted Utah’s use of the kind of financial “stress tests” that large banks have been subject to since the Great Recession. This testing tool allows Utah to gauge how its revenue and expenditures would decline in a range of economic downturn scenarios. Factoring in the expenditure side is a key improvement, as it allows policymakers to see that, as tax revenues shrink during the downturn, the state also experiences a swelling of Medicaid rolls, unemployment benefits and other spending demands that inevitably accompany a recession.

Utah’s policymakers have used this information to gauge the adequacy of their rainy day funds and identify areas of the budget that should be trimmed back now in preparation for the next downturn. But they haven’t stopped there. Back in 2011, Utah launched the Financial Ready Utah initiative, essentially planning for a financial disaster, recession or cuts in federal funds sent to the state.

The premise is that, just as states undertake risk assessment and contingency planning for potential natural disasters, they should also plan ahead for reductions or interruptions of federal funds. Utah now develops contingencies to ensure that priority programs can be maintained and that vulnerable populations will be served.

This effort has several key parts. First, it requires accounting for all of the federal funds that go through state agencies now, plus the strings that are attached to those dollars. Next is a risk mitigation assessment to identify potential ways to respond if there is a sudden or major reduction in those funds. Last, as part of their budgeting process, state agencies are required to do contingency planning and program prioritization that show how they’d shift strategies in the event of hypothetical 5 percent and 25 percent reductions in federal funds.

These efforts give Utah’s policymakers roadmaps to help navigate potential financial challenges that may hit at any time. The state’s readiness is far superior to trying to navigate the thorny politics of major state budget cuts on the fly.

Gov. Brown should consider replicating Utah’s approach to fiscal disaster planning. His warnings against profligate spending are wise and well placed, and he’s likely right that we are closer to the next recession than we are to the last one. Planning for an economic downturn will give the state a leg up on educating citizens and showing policymakers that, while difficult budget tradeoffs may be necessary, they need not be haphazard or destructive to California’s quality of life.

Leonard Gilroy is director of government reform at Reason Foundation. This article originally appeared in the Orange County Register.