Can closing a defined benefit pension plan to new hires and replacing it with a defined contribution plan help improve the solvency and sustainability of a state’s retirement system finances?

In 1996 the Michigan legislature voted to close its defined benefit plan for state employees, offering defined contribution retirement benefits for new hires. In the years since then the closed defined benefit plan has added over $5 billion unfunded liabilities. Some say that this evidence proves the answer to our question is, ‘no, inherently closing defined benefit plans creates unfunded liabilities.’ Yet, such a position is only highlighting the correlation between a closed pension plan and a growth in pension debt.

In order to understand whether closing the Michigan State Employees Retirement System (MSERS) defined benefit pension plan caused a growth in unfunded liabilities, or whether it helped to improve the sustainability of retirement benefits in the Wolverine State, we developed a model that allows us to test what would have happened if pension reform never passed.

Our model allows us to forecast the level of unfunded liabilities today if there had been no reform, and to test what unfunded liabilities would be if Michigan had managed the closure of the defined benefit plan differently. We also apply our model to the case of Alaska’s 2005 pension reform that closed both their Public Employees’ Retirement System (APERS) and Teachers Retirement System (ATRS) to see if there are similar results. In both cases, where unfunded liabilities have grown in the years following pension reform, we seek to understand:

- whether the closing of defined benefit plans was the cause of growth in unfunded liabilities,

- whether unfunded liabilities were bound to grow anyway because of actuarial assumptions,

- whether unfunded liabilities increased due to funding policies that were independent of closing a defined benefit plan, and/or

- whether closing the defined benefit plan prevented unfunded liabilities from growing more than they would have in the absence of reform.

Download the full Policy Study 450 [PDF], and see below for more resources on pension finance research.

The Counterfactual Model

The baseline for our counterfactual model is the actual experience of the defined benefit plan, measuring from the fiscal year before the plan was closed through fiscal year end 2014. For Michigan the time horizon is 1996-2014, for Alaska it is 2005-2014. We started with publicly available data drawn from plan valuations and comprehensive annual financial reports, including: payroll, employer contributions, employee contributions, investment returns, and benefit outflows.

The model assumes that states would have maintained a similar contribution policy with or without reform, since whether a defined benefit plan is closed or taking in new hires, the full actuarially determined employer contributions should still be paid in full. There is nothing about a plan being closed that should change whether or not employers pay their required contributions.

Since both Michigan and Alaska had patterns of underfunding, the actual employer contribution rate relative to the actuarially determined rate is a significant variable in testing alternative scenarios.

Similarly, another key variable for testing changes to unfunded liability forecasts is the actual rate of return for a plan’s assets. With or without reform, a plan would have seen the same rates of return over time.[1] Thus, our model assumes there would be no difference in the investment strategy of a plan if it had remained open to new members versus the actual experience of being closed.[2] Thus, for forecasts of a counterfactual scenario where reform didn’t happen, we apply the same rates of return as during actual experience. But we can also measure the change in unfunded liabilities if the pension plan had achieved its assumed rate of return.

Since the pension reforms adopted did not make substantive changes to benefits, the model assumes normal costs would have been the same in the absence of the reform; however, amortization payments would have been different. The most straightforward way to determine contributions to plan assets under a no-reform counterfactual scenario is to take the actual contributions and then add to them additional normal cost contributions, which is the primary approach we take for calculating the numbers we report in this study. (See the methodology section in the policy study for more details.)

Finally, we can reasonably assume that benefit outflows would have been similar to the actual experience if reform had not happened. Most changes to the plans we looked at were only for new hires, not existing members. Thus, retirement patterns have not been substantially influenced. For the new hires, there has not been enough time for their cohorts to start retiring in large amounts as no scenario we test involves 20 years or more of actual experience.[3]

Scenario 1: What if Pension Reform Had Not Happened?

There is no doubt that MSERS has more reported unfunded liabilities today than it did in the year before pension reform was adopted (even accounting for inflation). But did pension reform cause the increase in pension debt?

Between 1997 and 2014, employers paid less than 88% of their annual required employer contributions to the MSERS defined benefit tier. In some years the total employer contribution was less than 50% of the actuarially determined rate that should have been paid. The lower-than-required contributions made budgeting easier for lawmakers, but at the long-term expense of the plan, with the missed payments simply being added to unfunded liabilities.

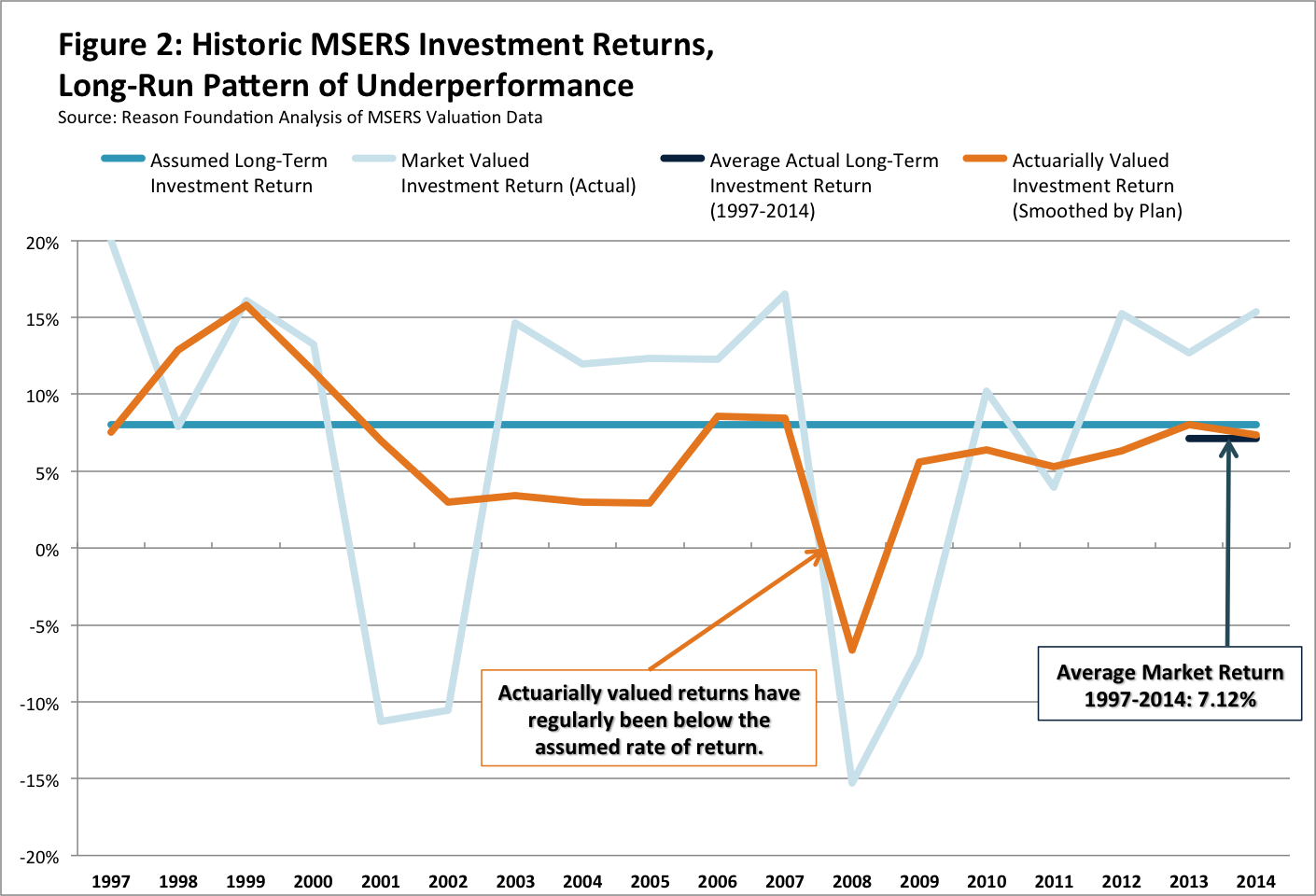

In the years since the defined benefit plan was closed, MSERS has also underperformed its long-standing 8% assumed rate of return. Between 1997 and 2014, MSERS has averaged a return of only 7.1% (see nearby Figure 2 from the policy study). Similarly, the actuarially valued returns (smoothed on a five-year basis by the plan actuary) have almost always been below the assumed rate of return since 2001. The net result of these poor investment returns over the past two decades has been to add to the unfunded liabilities of the defined benefit plan.

Other factors have been direct causes of growth in unfunded liabilities too, including the use of a very long amortization schedule for unfunded liabilities that has meant higher than necessary interest payments on the pension debt, a retroactive increase in benefits for employees who were willing to retire early, and the misuse of pension funds to provide a public backstop for a bond issuance to a private film studio that wound up defaulting on the loan.

Now, consider a counterfactual scenario in which the vote to close MSERS failed in the state legislature and no reform was adopted. The plan would have continued bringing in new members, but it still would have experienced the same underperforming investment returns. The additional unfunded liabilities would have resulted in actuarially determined employer contribution rates higher than actual experience, so we can assume that the state would have likely also become a serial under-contributor even without the passage of reform.[4]

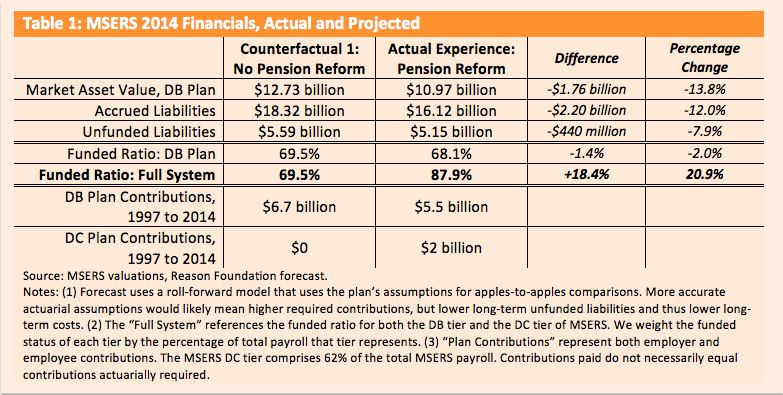

Table 1 provides a financial comparison of this counterfactual scenario to MSERS’s actual experience. (See the Methodology section in the policy study for details on our forecasting method for counterfactual scenarios.)

There are several important findings from this table. First, while we estimate the value of assets would be higher today without pension reform, so too would accrued liabilities. So much so that unfunded liabilities would be roughly $440 million larger today. At a minimum, the actual experience of the plan would be preferred to no reform because today’s unfunded liability is lower than it otherwise would have been.

Second, notice that the funded ratio for MSERS as a whole is better today (88%) under actual experience than it would have been without pension reform (70%). As of 2014, roughly two-thirds of MSERS payroll was in the DC tier, and member benefits for that tier are inherently 100% funded.

Scenario 2: What if Pension Reform Had Been More Responsibly Managed?

Michigan certainly could have done a better job?determining its funding policy and plan governance?over the last two decades during the plan closure. To?start, the state could have made 100% of its?actuarially determined employer contributions.[5] Plus, if the plan had achieved the assumed rate of return that was assumed when pension reform was adopted, unfunded liabilities would be much less.[6] This provides another benchmark to compare to actual experience: a counterfactual scenario where pension reform was better managed.

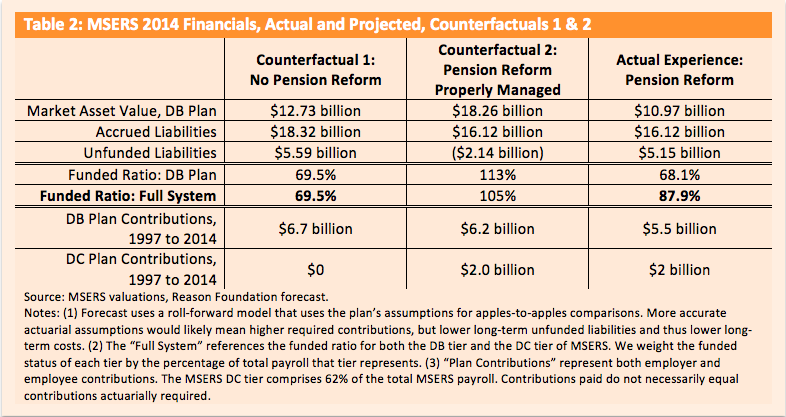

Table 2 compares MSERS’s plan financials of this second counterfactual scenario to the first counterfactual scenario of “no-reform” and to the plan’s actual experience. Specifically, we consider what the pension financials would look like if the plan’s actual investment returns matched the assumed rates of return, and if Michigan had a responsible funding policy of paying the full bill every year.

Better pension reform management-from the perspective of paying the full employer contribution rate every year-and targeting an achievable rate of return would have only affected the plan’s assets. We forecast that these two elements alone would have added roughly $7 billion to MSERS’s assets today. And since the accrued liabilities would not have been changed, this would have meant a $2.1 billion surplus for MSERS by the end of 2014.[7]

Given that the central research question for this study is focused on whether closing a defined benefit plan to new hires caused the increase in unfunded liabilities, this scenario helps to provide a baseline for what would have been the assumed future for MSERS when the reform was adopted. In this case we find that if all of the defined benefit plan’s assumptions at the time of pension reform had been accurate, then the plan would be in a better fiscal position today than both actual experience and if there was no reform.

The most sustainable scenario is adopting the pension reform of closing the defined benefit tier of MSERS and opening a defined contribution tier for new members, plus prudent funding policy and investment strategy.

Conclusion

We find that both Michigan and Alaska are better off specifically because they closed defined benefit plans compared to if they had made no changes. Unfunded liabilities have increased in both states since their reforms, but for reasons unrelated to the actual reforms: both states had underperforming investment returns, and both states failed to make 100% of their required employer contributions. Had Michigan and Alaska not closed their pension plans, unfunded liabilities would be even higher today than under actual experience. And had the states properly managed their pension reform projects they would be billions better off today. In effect, the states have ‘spent’ the savings from closing the defined benefit plans on other budgetary priorities.

By developing a forecast of what plan experience would have been like without closing to new members, we find Michigan is about $450 million better off today because of pension reform. As of the end of 2014, MSERS has an unfunded liability of $5.2 billion and combined funded ratio of 88%; by contrast, without pension reform closing the defined benefit tier, we estimate the plan’s unfunded liability would be $5.6 billion with a funded ratio of 70%. Assuming the plan would have experienced the same contribution rates, actuarial assumption changes, and investment returns, this means pension reform has saved Michigan around $450 million over 18 years. Plus, if the state had achieved its assumed rate of return and paid 100% of its annual required contributions, we estimate MSERS would actually be overfunded by about $2.1 billion, as of 2014-a $7.7 billion better financial position than without pension reform.

Similarly, Alaska is at least $40 million better off than if it had not closed its two main plans to new members. As of the end of 2014, APERS and ATRS have a combined $8.37 billion unfunded liability, and funded ratio around 71%. However, without reform the plans would be facing $8.41 billion in unfunded liabilities and a 58% funded ratio. Assuming the plan would have experienced the same contribution rates, actuarial assumption changes, and investment returns, this means pension reform has saved Alaska at least $40 million over 10 years. Plus, if the state had achieved its assumed rate of return and paid 100% of its annual required contributions, we estimate APERS and ATRS’s combined unfunded liability would be just $4.1 billion, meaning the plan would have been $4.3 billion better off if properly managed during reform compared to having no reform.

These findings are in contrast to a 2015 study from the National Institute on Retirement Security (NIRS), which argued, “changing from DB to DC does not decrease retirement plan costs, can drive up pension debt, and will almost certainly increase retirement insecurity.”The study specifically highlighted Michigan’s pension reform as evidence for how closing pension plans increases unfunded liabilities: “while the plan had excess assets on hand of some $734 million in 1997, by 2012, the plan amassed a significant unfunded liability of $6.2 billion.”

However, as we’ve shown, such a finding is conflating correlation with causation and inaccurately blaming the pension reform itself for the increase in pension debt. By constructing counterfactual scenarios, we’ve shown that the additional unfunded liabilities are due to factors unrelated to the closing of a defined benefit plan: the state’s failure to pay its full employer contribution and underperforming investment returns (which would have happened with or without the reform).

Policymakers considering similar reforms to Michigan and Alaska should understand that closing a defined benefit plan and replacing it with a defined contribution plan can improve sustainability. They should also heed the warnings that Michigan and Alaska present in recognizing that responsibly managing plans after reform is just as important as getting the initial terms of the reform right.

— Footnotes —

[1] This assumes that investment strategy that plans followed in the years after defined benefit plans were closed would have been the same without reform, and that without reform there wouldn’t have been any separate changes to investment policy. Given that there is no legal or fiscal reason to change the distribution of assets in a plan’s portfolio simply because a plan is closed, we consider this a reasonable assumption.

[2] The only investment return difference is that losses or gains would have been a magnitude greater if the plans had remained open, because there would have been more contributions flowing into the plan assets.

[3] See “Methodology” section for more details on how we forecast benefits. The biggest possible exception to our assumption is that Michigan offered an early retirement option to members who remained in their defined benefit plan as a means of turning over the payroll to defined contribution members faster.

[4] There are some obvious limitations to this forecast: we have to assume normal cost as a percent of payroll would remain the same (the actual rate would have likely varied slightly), and we have to assume the defined contribution tier’s payroll would have been the same if new hires went into the DB tier instead of the DC tier.

[5] This would have necessitated cuts in other programs or an increase in taxes, which are considerable policy considerations for a government as a whole. However, to the degree that under-contributing to a plan increases pension debt, the additional payments that will need to be made on that debt in the future are never attributed as costs of the programs (though, arguably, they should be). It is worthwhile to consider what fiscal policies are necessary to fund a pension plan on its own terms, separate from other policy considerations.

[6] We mean “better management” in the context of the assumed rate of return in two respects. First, the plan could have hired a different asset manager or better redistributed its assets so as to actually get the average return. This is, naturally, a critique that is only possible in retrospect, after seeing how average returns play out over a number of years. Presumably, the MSERS board did everything it could to manage the plan’s assets well. However, this leads us to the second way we mean “better manage”-the board should have lowered the assumed return to something manageable. This would have necessitated higher required contributions, but if they had been paid in full and the more achievable rate successfully attained, then the plan would be more solvent today. There are certainly policy trade-offs that come with increasing the contribution rates for a plan, but that does not negate the simple reality that if the plan had either done a better job of managing its assets, or better positioned itself for success (i.e. targeted a lower assumed return rate), it would be better off today.

[7] It is probable that well before a $2 billion surplus was reached, that funding policy would have changed to reduce contributions into the plan. However, a large surplus would have been beneficial to build because it would serve as a cushion against future potential underperforming markets.