Alaska Senate Bill 11 would re-open the defined benefit (DB) pension for new hires and allow all teachers and public workers currently in the defined contribution (DC) plan to use their DC account balances to purchase past service in the DB plan. This “past service” purchase mechanism puts an enormous amount of risk on the state in year one. Despite claims that the change would be cost-neutral, this move could realistically add over $9 billion in additional costs to future state budgets and reintroduce Alaska to significant pension risk—the same risk that generated over $6 billion in state pension debt and spurred the 2005 pension reform that closed Alaska’s defined-benefit pension plan to new hires in the first place.

Senate Bill 11;s costs are dependent on a flawed discount rate (DR)

The claim that SB 11’s proposed changes would not require any additional funding relies on the pensions’ current investment return assumption. Alaska’s pension plans would need to achieve overly-optimistic 7.25% annual returns on investments for decades to avoid additional costs to the state.

- Overly-optimistic investment return assumptions were a major contributor to Alaska’s $6.7 billion debt still owed on the legacy pension plans (PERS and TRS).

- Nationally, the average assumed return used by public pension systems is below 7%, so Alaska’s current return rate assumption is rosier than most other states.

- Capital market forecasts by most financial experts suggest pension systems should expect investment returns closer to 5%-6% for the next 10-to-15 years.

- The DR is used when pricing the amount needed from employees to purchase their “past service.” If the plan earns under 7.25% or drops that assumed rate in the near future, tens if not hundreds of millions of dollars in unfunded liabilities will have been added.

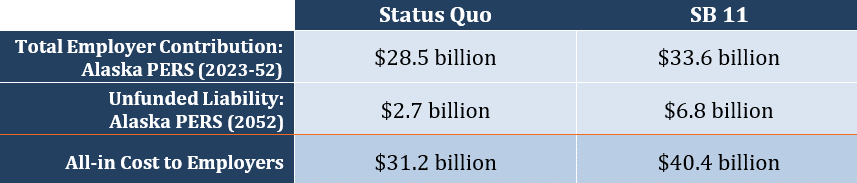

SB 11 could cost Alaska an additional $9.2 billion over the status quo

Actuarial analysis of Alaska PERS and TRS that anticipates realistic market stress and multiple recessions over the next 30 years shows SB 11 likely exposes the state to significant potential costs.

Bottom Line:

Senate Bill 11 would likely cost Alaska $9 billion in the coming decades. Since most of Alaska’s public employees leave their positions before being able to take advantage of a pension, this could be very costly legislation that only benefits a relatively small group.