The intent to limit tobacco use among youth is to be applauded. However, given Massachusetts’ already extremely low rates of youth smoking and the unintended consequences stemming from the state’s recent ban on flavored tobacco products, S.1848 should raise concern that the state will enlarge the already substantial illicit tobacco trade, push sales and tax revenue to other jurisdictions, and punish premium cigar stores and lounges that have almost no appeal to youth.

The Illicit Market and Youth Smoking

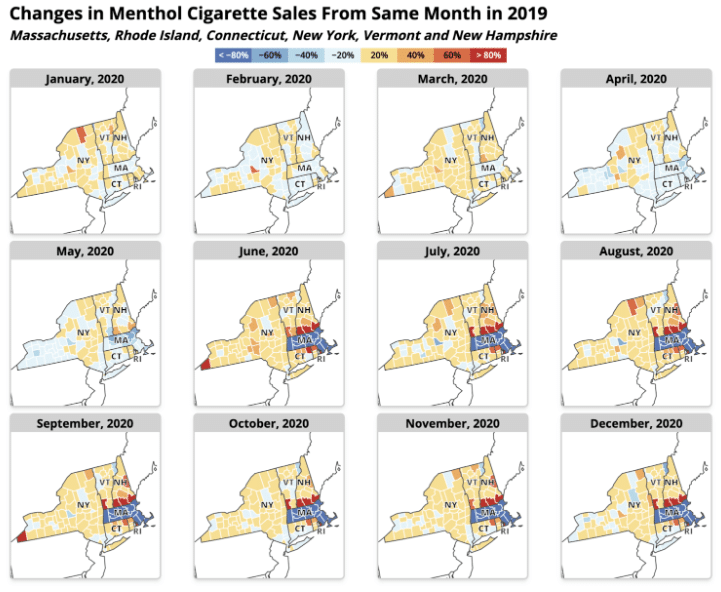

Massachusetts’ ban on flavored tobacco products went into effect in June 2020. Jacob James Rich, a researcher with the Center for Evidence-Based Care Research at the Cleveland Clinic and a policy analyst at Reason Foundation, analyzed the ban’s impact by comparing cigarette sales in Massachusetts and its bordering states before and after the ban was implemented. His research found a net increase in cigarette sales of 7.2 million packs within Massachusetts and its bordering states in the 12 months after the ban (July 2020 to June 2021) compared to sales in the year leading up to the June 2020 ban.

Massachusetts saw a 15.6 million pack increase in non-menthol cigarette sales in 2021, likely due to smokers switching to other products after the flavored tobacco ban’s implementation. The following graphic illustrates Rich’s findings, broken down at the county level.

Additionally, with consumers turning to neighboring states and black markets, according to the Tax Foundation, Massachusetts lost $116 million in cigarette tax revenue in the first 12 months of the ban.

Massachusetts has the sixth-highest cigarette tax in the country and the third-highest rate of inbound cigarette smuggling. The state’s Multi-Agency Illicit Tobacco Task Force is seizing so many flavored tobacco products that their most recent report requested more space to store them and asked for new criminal penalties to make it easier for them to crack down on smuggling and those possessing flavored tobacco products with intent to sell.

A further increase in the price of cigarettes provides yet more incentives for cross-border smuggling of cigarettes from neighboring states with lower excise taxes. In addition to boosting the illicit tobacco market, those smokers who buy their cigarettes within Massachusetts would face a substantial increase in their cost of living. Because smokers are disproportionately from lower-income backgrounds, an increase in the cigarette tax is especially regressive.

Furthermore, an additional cigarette tax is not required to deal with the problem of youth smoking, which is at a generational low. According to the Centers for Disease Control and Prevention’s (CDC) 2021 Youth Risk Behavior Survey, only 3.5 percent of Massachusetts high schoolers said they had smoked a cigarette in the past 30 days, and just 0.5 percent smoked frequently. Enforcement of the age of purchase for tobacco products and continued anti-smoking education is more than sufficient to end what little remains of youth smoking in the state.

In place of tax increases, Massachusetts could further reduce its already low adult smoking rate by implementing a strategy of tobacco harm reduction by ensuring safer nicotine alternatives authorized by the Food and Drug Administration, such as e-cigarettes and snus, are available to those adult smokers who want to quit.

Premium Cigars

S.1848 would double the wholesale tax on cigars, including premium cigars. Given that the bill’s stated intent is to protect youth from nicotine, it’s unclear why premium cigars, which have almost no appeal to youth, are being targeted for such a large tax increase. According to the National Academies of Sciences, Engineering, and Medicine, past 30-day use of premium cigars among minors is 0.1 percent.

While hazardous because of the process of combustion, premium cigars present little threat to public health due to the patterns of use among their smokers. In contrast to cigarette smoking, cigar use is an occasional behavior. Among premium cigar smokers, 60.3 percent reported smoking on only one or two days in the past 30 days, and just 7.6 percent smoke frequently.

Raising taxes on premium cigars would not improve health outcomes for young people. Such a large tax increase would, however, have a substantial impact on Massachusetts cigar stores and lounges as customers likely turn to neighboring states to avoid substantial price hikes, as has been the case with cigarette smokers.