During the pandemic, school districts received nearly $190 billion in federal COVID-19 relief funds–an unprecedented sum. Policymakers and education researchers encouraged school districts to spend these temporary funds helping students and on one-time expenses, such as tutoring, and bonuses for teachers in shortage areas like math, science and special education.

Yet, according to Edunomics Lab, 40% to 50% of these relief funds were spent on labor costs “including increasing teacher salaries and adding more staffing, particularly learning specialists, tutors and counselors,” The Hill reported.

Now, as federal relief funding dries up, many school districts can no longer afford to maintain these additional staff positions as public school enrollments as of the 2022-23 school year nationwide were four percentage points lower than pre-pandemic enrollments.

Even though state and local education funding is at an all-time high, these revenues aren’t enough to cover the difference as federal COVID-19 relief funds dry up. This is partially due to the fact that inflation significantly decreased the value of recent increases in state and local education funding.

In fact, Reason Foundation found that “between 2020 and 2022, nominal non-federal funding grew by $1,485 per student but only $55 per student after adjusting for inflation.”

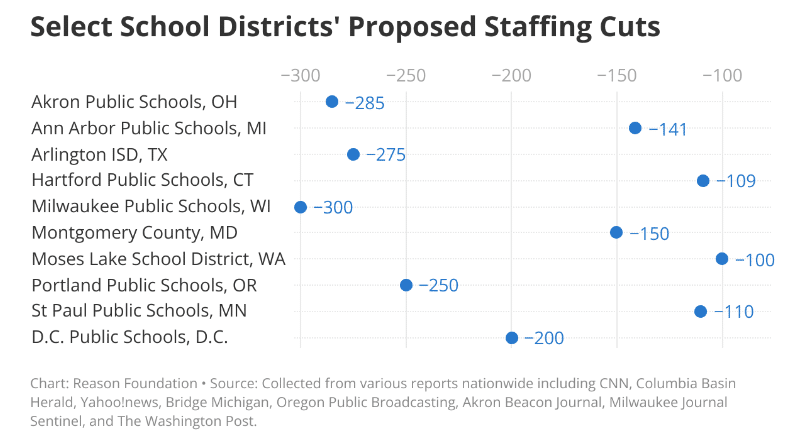

As a result, many school districts face major layoffs nationwide. The chart below highlights the magnitude of these layoffs in 10 school districts across the nation.

Moreover, in The74, Chad Aldeman estimated that school districts must eliminate 384,000 positions to return to pre-pandemic staffing levels. If this occurs, school districts would have to cut 20,000 more jobs than they did during the Great Recession, Aldeman noted.

However, layoffs aren’t school districts’ only option. School consolidation can save existing jobs and money, especially when student enrollments decline. School districts can save big bucks by closing under-enrolled schools and reassigning staff.

Marguerite Roza and Aashish Dhammani of Edunomics Lab estimated in The74 that “when a district has under-enrolled schools, closing 1 of every 15 schools saves about 4% of a district’s budget, mostly in labor costs.”

But these closures don’t necessarily mean staff layoffs since school districts can save money by reassigning them to vacancies in other schools. “The cost reduction,” Roza and Dhammani explain, “comes from not rehiring to fill those vacancies.”

Some school districts are already doing this. In Washington, Seattle Public Schools announced plans to close 20 schools. Similarly, Texas’ San Antonio Independent School District closed 13 schools last month. Closures could also occur in Hillsborough, Florida, and Plano, Texas.

Moreover, these closures are no surprise for many public school district administrators who have watched their enrollments steadily decline in recent decades and plunge during the pandemic.

These factors, combined with the expiration of federal COVID-19 relief funding and states’ temporary hold harmless provisions, which artificially inflated enrollments, have come to a head at once for many school districts, creating a “perfect storm,” White Board Advisors’ vice president and co-director of research David DeShryver told Education Week.

School closures are challenging for communities and often face fierce opposition from teacher unions and families, but school districts can’t afford to operate schools that are only half full. To successfully thread this needle, school administrators must be transparent with families and give them options.

In particular, state policymakers should ensure that families affected by painful but necessary school closures aren’t wholly left in the lurch. For instance, Utah Gov. Spencer Cox signed House Bill 341 into law this year, letting families affected by school closures choose their new public schools.

Legislative tweaks like this give families agency in their new school selection process instead of herding them into new schools regardless of whether they’re a good fit.

These reforms could make coming school closures and staffing cuts or reassignments less painful. Many school districts have no choice but to tighten their fiscal belts and including families in decision-making could make the process less painful.

From the states

In other important education and school choice developments across the country, Louisiana’s legislature passed a universal school choice program, and Oklahoma established statewide within-district open enrollment.

In Louisiana, Senate Bill 313 awaits Gov. Jeff Landry’s signature. If signed into law, all students would be eligible for a private school scholarship, which they could use to pay for private school tuition and other eligible education expenses. Step Up For Students reported that the scholarship will only be available to recipients who use it to pay for a single provider during the first year of operation, beginning in March 2025. However, scholarship recipients could use their funds to pay for multiple providers during the second year of operation.

In Oklahoma, Gov. Kevin Stitt signed H.B. 3386 into law which requires all school districts to participate in within-district open enrollment. This means that families can now transfer to any school inside their school district with open seats. Oklahoma is the first state to adopt all of the Reason Foundation’s best practices for open enrollment policies, making it the foremost leader in open enrollment nationwide

The Pennsylvania House passed House Bill 2370, which would establish a new funding formula and significantly increase K-12 education funding until 2031. Chalkbeat Philadelphia reported that Philadelphia schools would receive $1.6 billion during the next seven years if the proposal is codified. However, charter school supporters claim that the proposal shortchanges cyber charter schools since it caps school districts’ tuition payments at $8,000 per pupil. According to The Center Square, cyber charter schools’ tuition rates oscillate between $9,000 and $23,000.

Although the New Hampshire Senate approved House Bill 1665 last week, the House chamber voted to kill the bill, which aimed to expand students’ families’ income eligibility for the state’s Education Freedom Accounts. Scholarship recipients can use their accounts to pay for private school tuition, tutoring, and other approved education expenses.

What to watch

Applicants for the Oklahoma Parental Tax Credit last year exceeded the number of scholarships available. Approximately 36,000 students in Oklahoma applied for a scholarship, but nearly 16% of them or 5,600, were denied since the program is capped at $150 million. However, the cap is set to increase to $200 million next year and to $250 million in 2026. Depending on their income, recipients are awarded scholarships valued at $5,000 to $7,500 to pay for private school tuition.

Plaintiffs filed a lawsuit in circuit court against Arkansas’ new education savings account program, claiming that it violates the state constitution. Last year, the program provided scholarships valued at about $6,600 to more than 5,400 students.

Mississippi House Speaker Jason White announced plans to improve the state’s cross-district open enrollment law during the 2025 legislative session. Currently, the state operates a voluntary cross-district open enrollment program that allows students to transfer to schools in other school districts under very limited circumstances. Right now, Mississippi’s policy meets none of Reason Foundation’s open enrollment best practices.

Recommended reading

Interactive: In Many Schools, Declines in Student Enrollment Are Here to Stay

Chad Aldeman at The74

“Thirteen states — including Florida, North Dakota and Idaho — are projected to gain students by the end of the decade. But that means the rest of the country should brace for fewer students. Seven states — Hawaii, California, New Mexico, New York, West Virginia, Mississippi and Oregon — are all projected to suffer double-digit declines in addition to any losses they’ve already seen. California alone is projected to lose nearly 1 million public school students by 2031.”

Four takeaways from the U.S. Census Bureau’s latest school finance data

Aaron Garth Smith and Jordan Campbell at Reason Foundation

“Between 2018 and 2020, non-federal revenue went up nominally by $1,204 per student, resulting in a $769 increase in real terms. During this time, 43 states increased their inflation-adjusted non-federal funding per student. Had inflation stayed at its pre-pandemic level, non-federal funding would’ve gone up by roughly $938 per student between 2020 and 2022 rather than the $55 per student observed.”

Ohio’s school funding formula is hurting open enrollment

Aaron Churchill at Fordham Institute

“Funding policy should encourage rather than discourage districts to meet the needs of more Ohio families and students. The state’s new funding method misses that mark, and without change, we may see even more districts closing off open enrollment opportunities. The best way forward for state lawmakers is to restore the traditional approach to funding open enrollment by setting a simple, flat per-pupil amount that all districts receive when they open enroll.”