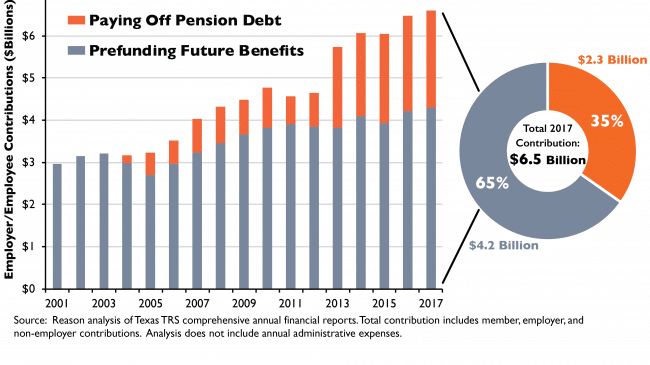

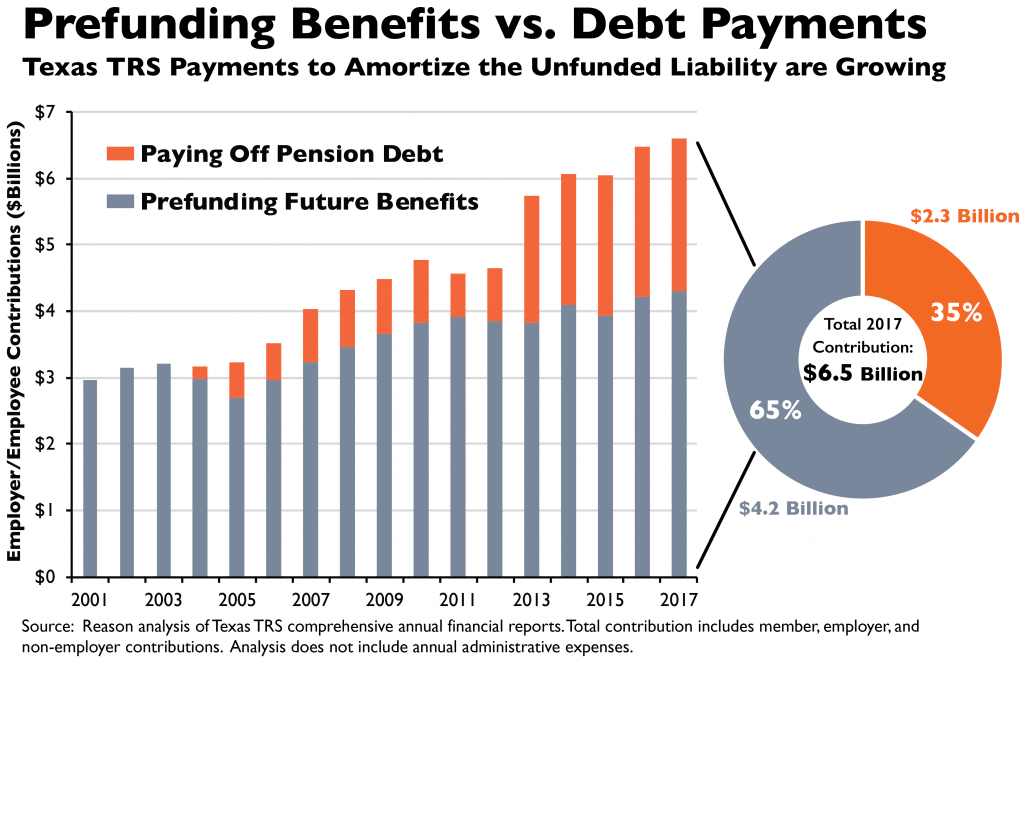

Every pension plan has a “normal cost”—the annual contribution necessary to fully prefund the plan according to actuarial assumptions. In a fully funded plan, the normal cost is the only necessary contribution to ensure the fund covers all future promised benefits. By contrast, an underfunded pension plan is forced to make amortization payments in addition to the normal cost to pay down any unfunded liabilities that accrue when actuarial assumptions are missed. The Teacher Retirement System (TRS) of Texas’ amortization payments have grown since 2003 and take up an increasing amount of teacher and state contributions.

Where Do TRS Pension Contributions Go?

- Annual costs for TRS are trending up, largely due to rising costs associated with paying down growing unfunded pension liabilities—the gap between the amount of promised pension payouts and the amount needed on hand today to fully fund those promises and ensure all promised benefits are fully paid.

- In 2017, contributions totaling $6.5 billion went into the TRS fund, half coming from employers and half from teachers.

- Of those contributions, only 65 percent ($4.2 billion) was used to prefund benefits for active teachers. The remaining 35 percent ($2.3 billion) was used to pay down unfunded pension liabilities, meaning that teachers and districts are increasingly paying for unfunded benefits accrued from previous years.

Unfunded Liabilities Are Forcing Texas TRS Pension Contributions Ever Higher

For more information, please visit — Pension Solvency Overview: Teacher Retirement System (TRS) Of Texas