Every few months a story goes viral about another airline skimping on an in-flight amenity or beginning to charge for a service that was once taken for granted. While these stories can sometimes be blown out of proportion, the line between U.S. legacy airlines (American Airlines, Delta Air Lines and United Airlines) and newer, low-cost carriers (Allegiant Air, Frontier Airlines and Spirit Airlines) continues to blur. While some travelers may choose to avoid low-cost carriers, these airlines have provided tremendous value for both individual travelers and the broader American airline industry.

The low-cost phenomenon began in the 1980s with the advent of Southwest Airlines and People Express Airlines. People Express merged with Continental Airlines in 1987, and Southwest has since transitioned away from the ultra-low-cost business model. Analogous to Ikea’s revolutionary approach to the furniture and appliance market, ultra-low-cost carriers apply the mantra “pile it high, sell it cheap”—meaning they aim to sell large numbers of seats at the lowest possible fares.

Travelers should fully understand the tradeoffs they’re getting when purchasing a ticket on budget airlines. Ultra-low-cost carriers typically offer passengers very low base ticket prices but then charge for offerings and services that may be available for free (really meaning they are built into the ticket price) by legacy carriers, such as free carry-on luggage or beverage service during a flight. Deep-discount flying is ideal for flyers who travel lightly, want to bypass ancillary fees, do not need inflight meals or entertainment, and prioritize the most cost-effective way of getting to their desired location.

Today’s budget carriers are attracting passengers from legacy carriers and inducing new travel by those who are willing to trade some comfort or amenities for lower prices. Travelers who may have once been priced out of flying now have more budget-friendly options. According to the Bureau of Transportation Statistics (BTS), between 2013 and 2018 ultra-low-cost carriers nearly doubled the percentage of passengers they served at U.S. airports as a percentage of all U.S. carriers.

As a result, some legacy airlines have cut economy class ticket prices across the board, while others have reinvented their own pricing structures. To compete with the ultra-low-cost business model, legacy carriers now try to attract passengers by advertising things like a “basic economy” fare that is often comparable to tickets from the low-cost carriers. These base fare pricing options at legacy carriers may charge additional fees for passengers who want assigned seats, checked bags and other items. When legacy airline customers see the conditions of the basic economy fare, they may opt for a “main economy” or “main cabin” fare, which tend to be less restrictive tickets at a higher price. Legacy carriers, driven by the low-cost competition, are attempting to capture the best of both worlds. They are trying to appeal to the cost-sensitive, no-frills traveler that budget carriers are attracting, while also leveraging their larger brands and in-flight ambiance to maintain their relationships with business travelers and frequent flyers. The budget airlines are forcing established carriers to give consumers more options.

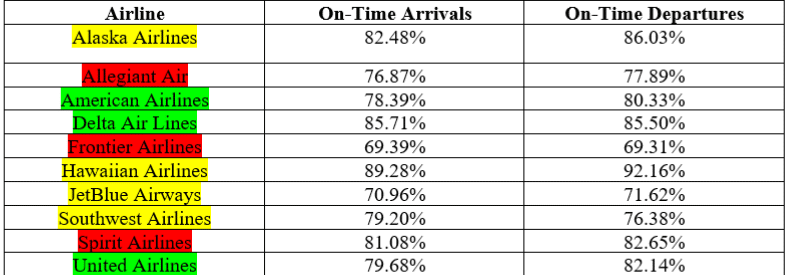

Examining on-time performance data for both arrivals and departures in 2018 shows that ultra-low-cost carriers outperformed some of their legacy and hybrid (carriers that exhibit characteristics from both legacy and ultra-low-cost carriers) peers.

Table 1: On-Time Performance of U.S. Legacy, Hybrid and Low-cost Carriers in 2018

Source: On-Time Performance – Flight Delays at a Glance. January – December 2018. Bureau of Transportation Statistics.

The above table highlights the nuance in on-time performance among the legacy, hybrid and ultra-low-cost carriers. There is no clear correlation between the business model and operational efficiency. For example, Delta outperforms the other legacy carriers (shown in green), as well as the ultra-low-cost (shown in red), and most of the hybrid carriers (shown in yellow). Yet, in 2018, low-cost Spirit Airlines performed better than legacy carriers American, JetBlue, and United. Aside from Frontier’s struggles, the data show low-cost carriers effectively competing with legacies and hybrids from an efficiency standpoint, challenging the conventional wisdom that the ultra-low-cost carriers’ business models may degrade their performance and prevent them from directing appropriate resources toward their operational sides.

While ultra-low-cost carriers offer tremendous value to certain travelers, they are not without their shortcomings, particularly for customers traveling with luggage or needing to select assigned seats—like families traveling with young children. The ancillary fees added after booking typically substantially increase the price of a ticket on low-cost carriers.

For a direct comparison, consider a one-way ticket on Spirit Airlines from Chicago’s O’Hare International Airport to Los Angeles International Airport (LAX) that was advertised at just $90.29. But after adding one carry-on bag, one checked bag, and choosing a seat, the total cost of flying Spirit jumped by $126.00 to $216.29. Compare that to a ticket on legacy carrier United, where a “main cabin” fare on the same route departing on the same day and same hour was $178.30, which included seat selection and a carry-on bag. A checked bag would add $25.00 to the total cost, bringing it $203.30. For some travelers the $90 ticket on Spirit is fantastic, for others it would end up being more expensive than flying on United.

Ultimately, options and choices are good for consumers. Some passengers don’t need to bring bags or select seats, while others may find the a la carte fee model of low-cost carriers problematic. Other travelers grow frustrated as they see features that have been traditionally included in the ticket price become add-ons with fees. Services such as inflight entertainment options, power outlets on planes, food and beverage services, airport lounges, and various amenities may not be offered by low-cost carriers as they seek to keep their own costs down. Additionally, ultra-low-cost carriers do not offer first-class or business-class cabins. Travelers have also found the customer service experience to be lacking compared to that of their legacy peers. But, then again, complaints of long delays, ineffective or dismissive customer service agents, and an overall confusing customer service process when needing to change flights or deal with other problems, have become ubiquitous when dealing with carriers of all sizes.

Low-cost carriers offer value and a wider range of options that may especially help some underserved travelers and customer groups. And ultimately, the competition is part of the reason air travel is cheaper than it has ever been, which benefits all travelers.