The Airline Deregulation Act of 1978 is widely viewed by economists as one of the great policy reform success stories of the late 20th century. The law phased out strict federal regulation of interstate airfares and routes that had established a cartel in the 1930s, allowing new competition that greatly benefited consumers with more travel options at lower prices.

Vanderbilt University law professor Ganesh Sitaraman disputes these benefits in a contrarian essay for Politico Magazine, arguing that airline deregulation has led to monopolistic behavior in the form of higher prices and reduced service that must be countered by reviving the economic regulation of the past. But Sitaraman’s position suffers from a flawed understanding of airline deregulation and its results and crumbles under minimal scrutiny. Instead, policymakers should pursue pro-competitive reforms backed by evidence.

Most of the airline industry strongly opposed airline deregulation when it was proposed, and the harshest criticism of these reforms since then has often come from executives of airlines that financially benefited from anti-competitive government regulation. Sitaraman’s argument is a familiar one: Deregulation raised prices and reduced service—especially to smaller communities.

With respect to prices, Sitaraman at least acknowledges that deregulation initially led to more competition and lower prices. However, he claims this improvement was only temporary and that “the big airlines fought back, and they eventually pushed out the upstarts by matching or dropping their prices, only to then raise their prices after winning the price war. By the end of the 1980s, after many mergers and bankruptcies, the airline industry had reconsolidated with the same handful of big airlines dominating the market.”

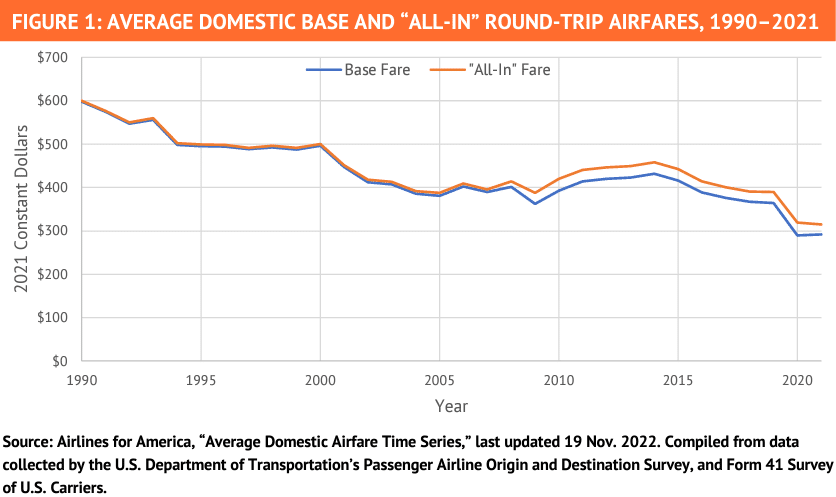

This predatory pricing story is difficult to square with observed outcomes. Today, average inflation-adjusted airfares are about half what they were before deregulation. As Figure 1 shows, this downward trend did not stop in the late 1980s: It continued over the past three decades. Economists don’t attribute the entirety of the declining trend in airfares to deregulation, but much of it can be explained by two complementary elements of deregulation: 1) the legalization of price competition between carriers; and 2) the legalization of interstate route entry by low-cost competitors like Southwest, Jet Blue, and Spirit.

In testimony to the Senate Commerce Committee earlier this year, Brookings Institution economist Clifford Winston surveyed the economics literature on airline deregulation and concluded that “it is very difficult to construct a plausible counterfactual that would provide empirical evidence that re-regulation or some new regulation of fares would benefit air travelers.” Winston went on to imagine likely outcomes if a naïve Congress reimposed airfare price controls:

The airline industry has periods when they are highly profitable, but they also have periods when they lose a lot of money. Airlines cannot stay in business in down times—and several have been liquidated—if they must sacrifice revenue that is generated when demand is high. So, if forced to sacrifice revenue due to fare regulation, they will try to make up for lost revenue elsewhere and create other problems in the process. To wit, paying employees less would mean more employee turnover and a less experienced workforce; raising the price of checked luggage would turn cabins into hand-to-hand combat zones for overhead space; jamming more passengers into cabins would require narrower seats with (even) less legroom and longer boarding times; and so on.

But the thrust of Sitaraman’s argument has less to do with airfares than it does with airline service. As a former student and staffer of Sen. Elizabeth Warren (D-MA), it is no surprise that perceived industry concentration is his major concern. He alleges post-deregulation industry consolidation has led to the concentration of air service at a small number of large hub airports. This in turn, claims Sitaraman, has led to reduced airline service to smaller communities. This fear was present in the 1970s, which is why, as Sitaraman notes, Congress established the Essential Air Service subsidy program as part of the Airline Deregulation Act. There are two major problems with this story.

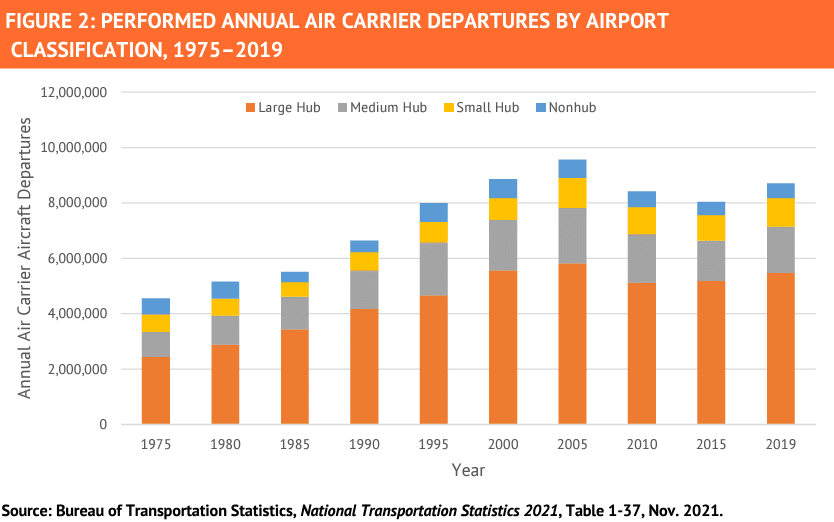

First, while the hub-and-spoke airline network model was adopted by many carriers following deregulation, concentration at large hubs has not been as dramatic as Sitaraman claims. As Figure 2 shows, traffic growth since 1975 was greatest among large hub airports, but this large-hub bias has not been consistent over the last four decades and has actually declined from its peak two decades ago. In fact, economists Severin Borenstein and Nancy Rose found that after controlling for increases in average trip distance, “a substantially smaller share of customers changed planes in 2011 than in 1979” (pages 92-93). While most travelers will prefer flying direct over changing planes, it’s worth noting that the hub-and-spoke model benefits travelers by facilitating greater service frequency to more destinations than would be possible under point-to-point networks.

Second, anecdotes about specific route changes over time tell us little about the functioning of the air travel market. This is especially true of Sitaraman’s anecdotes about very recent reductions in service that followed the COVID-19 pandemic, which led to a cratering in demand and an unprecedented spike in airline employee retirements. This left carriers with insufficient crews to operate marginal routes served by smaller aircraft when demand surged back faster than expected.

In normal times, the amount of air travel demanded may fall due to declining population or rising poverty that result from broader regional economic factors. Sitaraman mentions Toledo, Ohio’s loss of airline service in the years that followed deregulation, but fails to mention Toledo’s long-term deindustrialization driven by the contraction of Toledo’s glass and automotive manufacturing industries that began in the 1970s. The city of Toledo lost nearly half its population. Most of the increasingly suburban Toledo-area residents are within a 40-minute drive to Detroit’s large-hub airport, making it harder for Toledo Express Airport to compete for passenger traffic.

Like all firms, airlines should be able to adapt to changing economic conditions. A mandate that airlines should provide the same level of service to a declining customer base would prevent airlines from providing more service to growing customer bases elsewhere.

Over time, while some cities may lose service, other cities may gain service in a market-driven environment that encourages competition and innovation. Examining the U.S. commercial aviation market as a whole, Borenstein and Rose found that the number of city-pairs served by nonstop airline service increased substantially following airline deregulation (page 94). Much of this increase can be attributed to the widespread introduction of regional jet service in the late 1990s. “Overall,” they note, “26 percent of [regional jet] flights in July 2011 were on routes that had no nonstop service in July 1997.” Locking in routes from 50 years ago would have denied consumers the benefits from this enhanced service.

Despite Sitaraman’s mischaracterization of the effects of airline deregulation and misguided call for reviving strict regulation of prices and routes, policymakers would be wise to identify policies that would enhance competition in the airline industry and benefit consumers. Earlier this year, Reason Foundation published my whitepaper that surveys the history and results of airline deregulation, along with three recommended pro-competitive reforms. Those three policy recommendations are:

- Adopt the longstanding Federal Trade Commission definition of “unfairness” to prevent the Department of Transportation from chipping away at the Airline Deregulation Act under the guise of consumer protection, such as by limiting airfare unbundling that would disproportionately harm low-cost carriers that exert most of the downward pressure on airfares.

- Eliminate the statutory $4.50 cap on the Passenger Facility Charge, a federally authorized local airport user fee, to enhance the ability of airports to self-finance their own improvements and limit the influence of dominant airlines in airport capacity decisions.

- Negotiate international agreements to repeal cabotage restrictions that prevent foreign carriers from serving domestic routes.

These three reforms would avoid the harms of price and route regulation while better targeting existing barriers that do dampen competition in the airline industry and reduce consumer welfare. For more detail on each of these proposals, see “Airline Deregulation: Past Experience and Future Reforms.”