Introduction

Having passed some trendsetting reforms to the state’s public pension system, Montana’s policymakers and public pensioners can count the state’s 2023 legislative session a success, especially for public safety pension beneficiaries.

The legislative reforms came in two phases; one focused on Montana’s public pension fiduciaries, and the other focused on the technical funding mechanism used to pay for pension promises made to public safety members.

Together the measures strengthen the commitment made to active and retired public workers by the state to properly manage the assets currently held on behalf of members and their taxpayer underwriters and fully fund all accrued pension benefits in a way that doesn’t burden future generations.

Keeping Politics Out of Public Pension Decisions

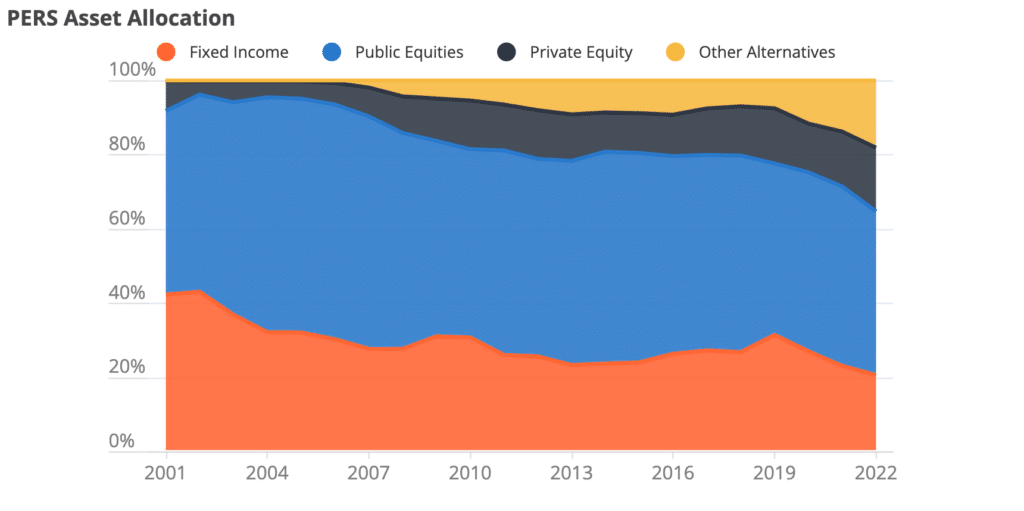

Montana’s legislative effort comes at an opportune time, as the nature of pension investments continues to evolve into an increasingly private and opaque market. Public pension systems and other public trusts no longer rely on vanilla investment portfolios of stocks and bonds. To catch up on previously unfunded liabilities and try to meet overly optimistic investment return assumptions, Montana’s pension systems are increasingly relying on alternative investments, like private equity and hedge funds.

Since 2000, asset allocations within Montana’s public pension investment portfolios have moved from 90% fixed-income assets and large U.S. equities to now having one-third of investments comprised of private equity, real estate, and other alternatives.

This trend toward these private market assets, mostly governed by limited partnership arrangements, has helped foster conditions for activists to leverage public dollars to push their ideologies or political agendas. The most direct example of this activism is proxy voting advisors using politically-inspired benchmark guidelines to vote on a public pension system’s directly held shares.

A less direct tactic is used by general investment partners like BlackRock and State Street, who sometimes take the funds committed by their limited partners to purchase massive amounts of stock in companies and then pressure the management of those companies to comply with their political goals. However, as some general partners begin to focus more on constant, direct management engagement over very public shareholder resolution battles, the need to clarify the role of a public fiduciary in this investment environment could not have been clearer.

Although it is reasonable and prudent for pension administrators to expand or contract the fund’s investments in various assets over time, the shift to private assets presents a new risk for policymakers and pension fund stakeholders—politicizing pension fund investments.

House Bill 228 was a major update to the rules governing the fiduciaries responsible for Montana’s public pension systems. The measure struck a balance between the flexibility that fiduciaries need to execute their long-term investment strategies and the need for taxpayers and beneficiaries to know their public pension contributions are not being used as leverage by any financial activist. By clarifying that a fiduciary’s duty is based on pecuniary factors only, House Bill 228 provides public fiduciaries the cover to turn away investments that lack quantifiable evidence for their investment claims.

As some major asset managers and general partners like Black Rock and State Street continue to commit public pension dollars to political causes, Montana’s pensioners can rest assured that their retirement nest egg is being managed responsibly.

Pension Contribution Policy Challenges

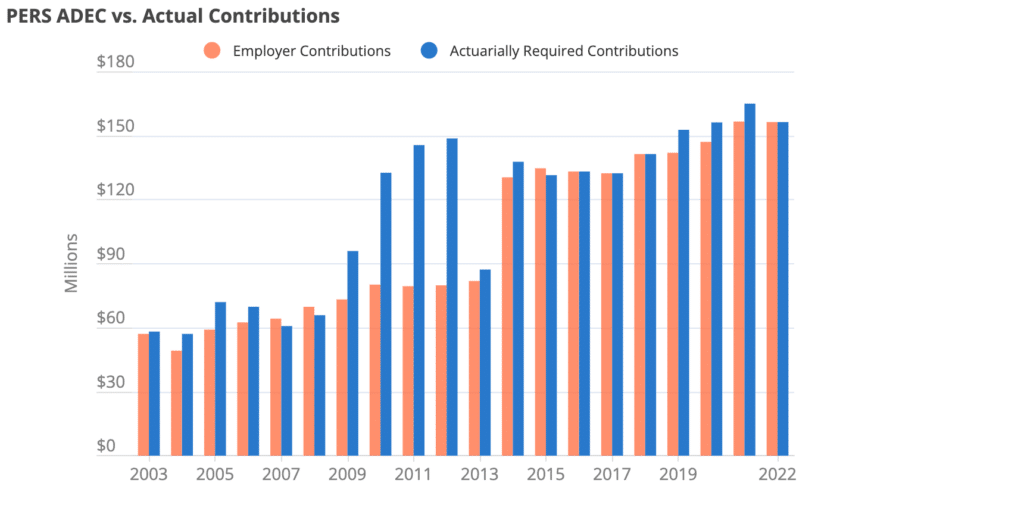

Pension funding has long been a challenge for Montana’s lawmakers. Due to an inflexible method of determining annual payments, the state has fallen short of its pension obligations in 13 of the last 20 years. During an August 2020 hearing of the Legislative Finance Committee, actuaries for the Montana Public Employees’ Retirement System pointed out that “states are getting away from the old statutory funding method” and that “an actuary’s dream (pension) funding policy” is a system that adjusts “to keep up with how the plan is doing.”

A month later, in a forecast for the 2023 fiscal year, the Legislative Fiscal Division’s report warned that “[C}urrent [pension] funding policies leave the systems [Montana’s Teachers’ Retirement System and PERS] heavily reliant on investment earnings and unable to adjust contributions to maintain an actuarially sound basis in times of significant financial declines.”

Fortunately for Montana taxpayers, state legislators partially heeded those warnings during the 2023 regular session by adopting House Bill 569. The measure commits the state to follow plan actuary recommendations when contributing to fully fund the retirement benefits of the Highway Patrol Officers’ Retirement System, the Sheriffs’ Retirement System, and the Game Wardens’ And Peace Officers’ Retirement System within 25 years.

Unfortunately, given the scale of PERS and constraints on local budgets, the legislature’s effort to provide taxpayers and PERS beneficiaries with the same peace of mind through the passage of House Bill 226 failed in the State Senate despite receiving bipartisan support in the House.

Historically, Montana’s state-sponsored public pension systems have suffered from the limitations of the current funding policy, but none at the scale of PERS. System actuaries and legislative watchdogs have long warned legislators of the outdated funding mechanisms supporting the state’s public pensioners. The direst warnings came during conversations about the long-term solvency of PERS.

Committing to Fully Funding Montana’s Public Safety Retirement Benefits

State policymakers must fund pension benefits at the rate that system actuaries determine is needed annually to avoid underfunding newly earned benefits and make up for billions worth of previously unfunded benefits. The cost can fluctuate significantly depending on investment return rate assumptions and actual market outcomes, which can challenge annual budgets. However, years of continued underfunding of retirement benefits cannot be an option, as this only generates more unnecessary long-term costs for the state and taxpayers.

House Bill 569 reflected that reality and has set Montana on a path that not only funds all earned benefits by the state’s public safety officers but ensures any future benefits would be systematically funded within a decade. The measure should serve as a model for the state’s other pensions struggling with growing unfunded liabilities and expenses.

Backgrounder: Actuarially determined contributions would reverse Montana’s pension debt trends

Public Employee and Teachers Funding Challenges Remain

The state’s two largest pension systems in Montana, TRS and PERS, should follow this example by fixing the outdated funding mechanism administrators and legislative analysts warned will drive costs higher and weaken these systems’ long-term solvency.

Without the basic reforms in the unsuccessful House Bill 226, both retirement systems will remain in a precarious position navigating the increasingly private and volatile global investment market. The cost of bridging the 20% gap between teacher and public employee system assets and liabilities will be commensurate, requiring a partnership between the state and local employers, among other stakeholders with real skin in the game. This is why policymakers cannot look at funding policy alone.

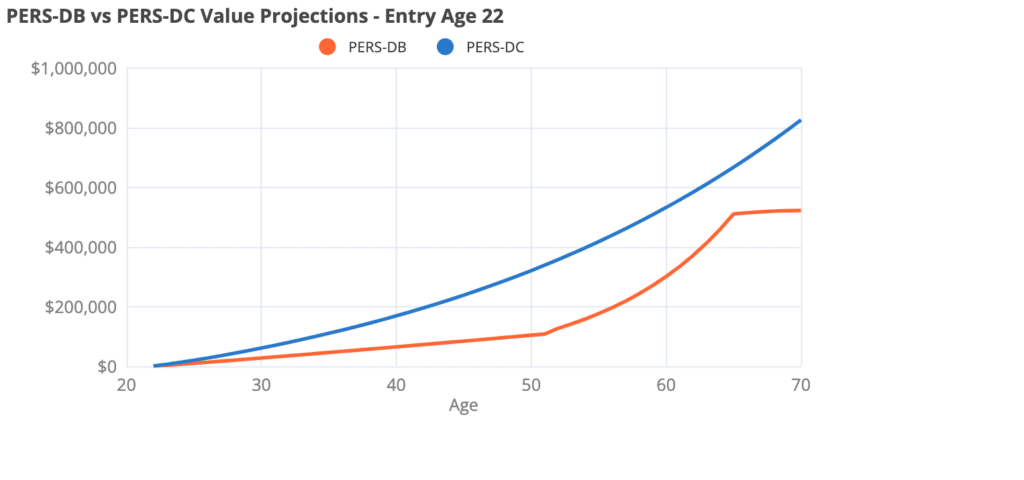

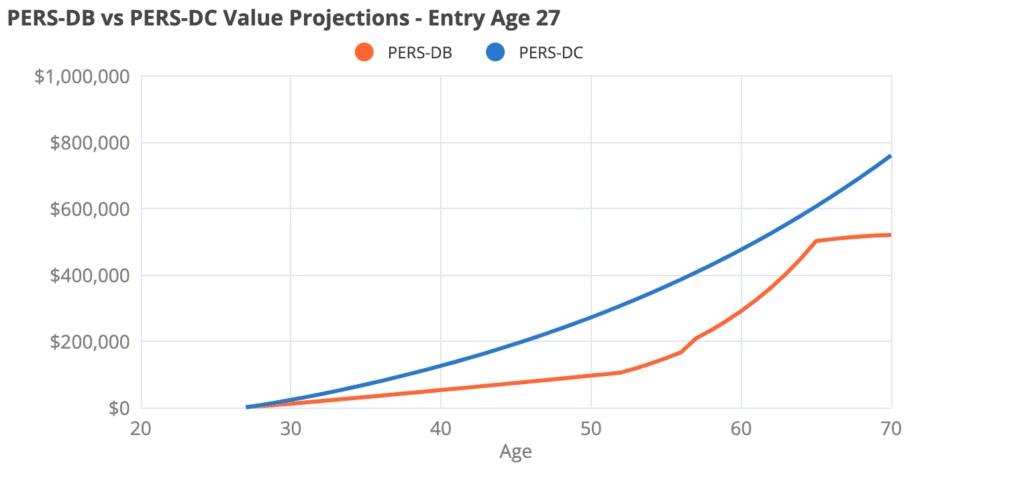

Montana’s Default Pension Benefit Is Not Working for the Modern Workforce

Using the Public Employee Retirement System’s assumptions, the Pension Integrity Project estimates that 70% of all new PERS members starting in their early 20s will find other positions outside of Montana public service within five years. This raises questions about whether the PERS-Defined Benefit (PERS-DB) pension is the best option for this group. Only 9% of employees hired in their early 20s stay employed for the 30 years required to earn an unreduced PERS-DB retirement. This suggests that the current default pensions for all public workers have only served a fraction of the workers at an ever-rising cost to taxpayers.

As of the 2022 PERS valuation, a new public employee that enters the PERS-DB will see at least 7.9% of their paycheck contributed to the pension fund until they leave public employment. For those who leave their jobs within five years of being hired, the PERS-DB acts more like a temporary savings account, giving the employee back only what they put into the system, plus interest, while forfeiting any employer contributions made toward their pension benefit.

House Bill 226 recognized the trends of the modern workforce. It would have shifted the default benefit offered to new hires from the PERS-DB plan to the PERS-DC (defined contribution) plan while preserving choice to ensure employees can best match their retirement plan with their particular situations.

This would have allowed for more portability and greater retirement security for the vast majority of employees hired by Montana governments, not just a relatively small group of full-career workers. The bipartisan measure maintained the current PERS-DB benefit as an option for new hires who intend to serve out their careers in public employment. Only affecting prospective state employees, HB 226 preserved the status quo for all active PERS-DB members, retirees, and their beneficiaries.

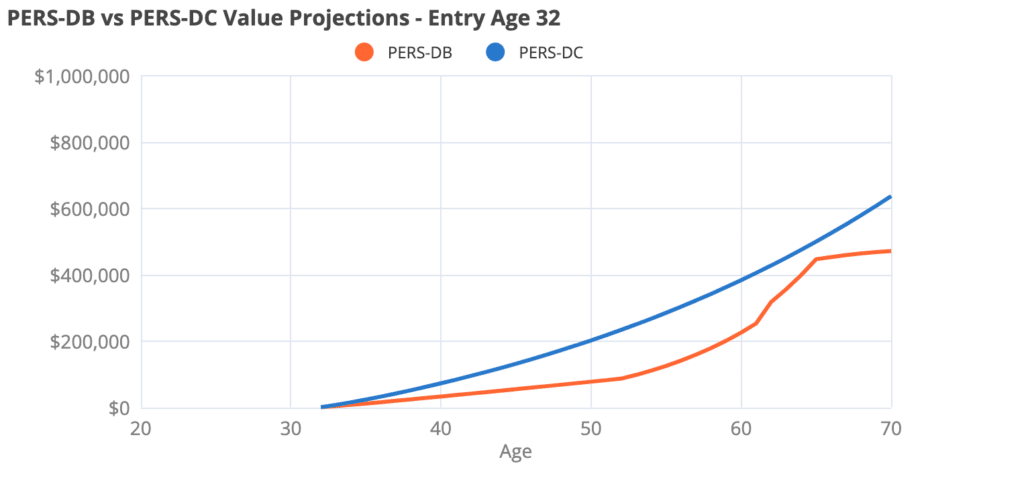

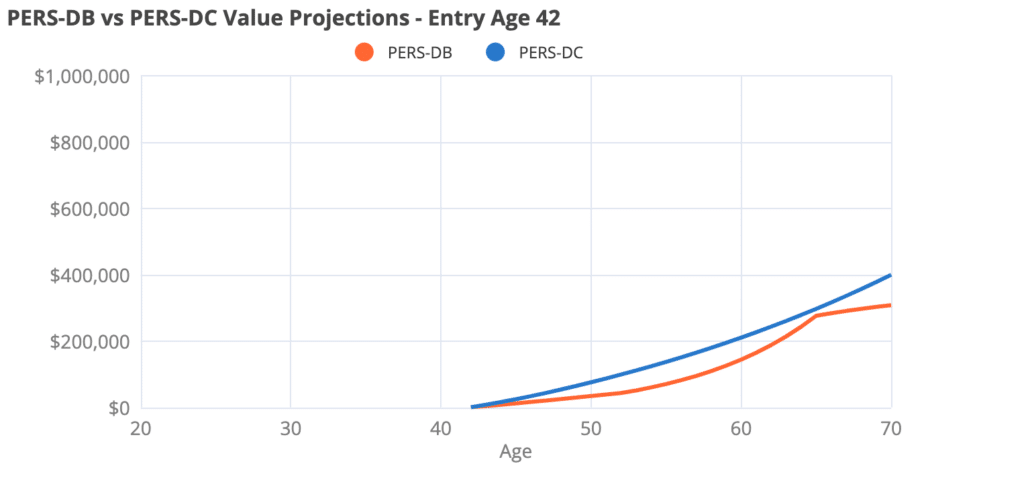

Based on the contribution rates proposed in HB 226, any employee at any age that chooses to leave their public employer within 25 years—meaning, most of the future government employees hired—would be better prepared for retirement with the proposed default PERS-DC benefit.

Backgrounder: The PERS-DC benefit best serves the majority of Montana workers

Conclusion

Policymakers, public workers, and taxpayers should be proud of the 2023 legislative results. The major policies adopted this spring will help protect the state’s public pension dollars from being leveraged by political activists. The state has also committed to fully funding all earned pension benefits for public safety workers.

Still, much more work must be done if state and local leaders want to offer the same funding commitment to all other public employees and educators. Most public employees will still join the public workforce only to be left upon separation with their wages and little to no meaningful progress towards a secure retirement. The longer it takes for the state legislature to move the remaining systems to an actuarially determined funding rate, the more expensive it will become for members and taxpayers, and the fewer people the pension systems will serve as a result.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.