Arguments concluded last November in U.S. vs. Google, one of the most important antitrust trials in recent history, focusing on whether the massive tech company has an unfair monopoly on internet searches. The outcome of the trial will depend, in part, on which definition of an “internet search” the court embraces.

The Department of Justice (DOJ) is pushing a definition of the search engine marketplace that is inappropriately narrow and fails to capture the role of search in consumer behavior. Essentially, the Justice Department is trying to convince the courts, and the public, that Google faces less competition than it actually does.

The Department of Justice alleges that Google has a monopoly in the general search engine market, but deliberately excludes real competition from specialized providers and emerging threats. Here’s how the complaint defines a general search service:

“Consumers use general search services to perform several types of searches, including navigational queries (seeking a specific website), informational queries (seeking knowledge or answers to questions), and commercial queries (seeking to make a purchase).”

General search engines are extremely versatile; in addition to traditional text search, they can provide mapping and directions, search for images, and find peer-reviewed research. More technically, these search services use their software to browse the web—a process called crawling, index those pages, and sort them when users use the service. Under this definition, Google holds 88% of the search market share.

However, the DOJ’s definition of the search engine market has little basis in how people actually use internet searches and ignores a variety of ways non-Google search tools have been integrated into other activities online.

The Department of Justice has excluded specialized vertical providers (SVPs) from the department’s complaint. SVPs are engines where consumers search for specific goods or services. The DOJ argues specialized vertical providers should be excluded from the relevant market because they are inadequate substitutes for general search:

“Other search tools, platforms, and sources of information are not reasonable substitutes for general search services. Offline and online resources … and specialized search providers such as Amazon, Expedia, or Yelp, do not offer consumers the same breadth of information or convenience…Thus, there are no reasonable substitutes for general search services.”

The DOJ may dismiss specialized vertical providers as holding any valuable market share, but Google thinks otherwise. During the trial, Google made the argument that the internet is providing plenty of alternatives to “one-stop shops,” and that the number of individual queries is the best way to assess the internet search market.

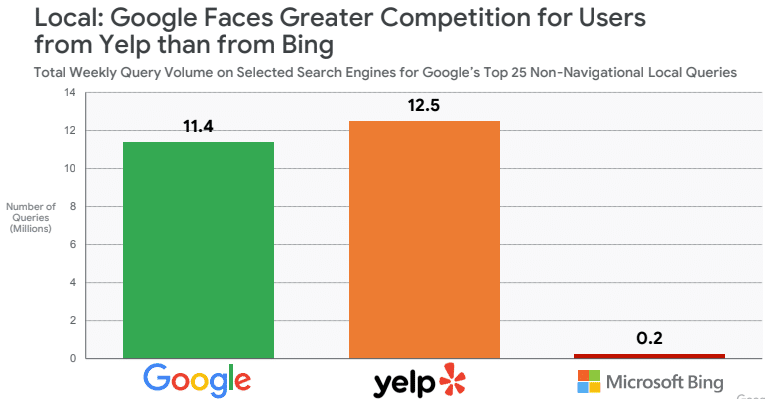

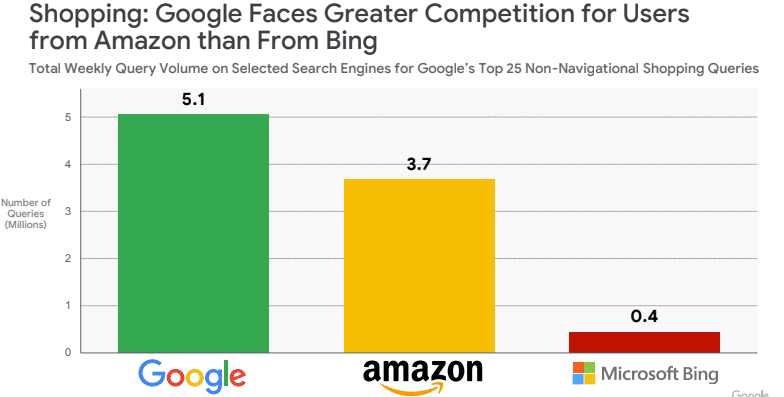

Using this logic, specialized vertical providers compete with Google to meet search demand. For example, consumers flock to Amazon, the fourth most popular website in America, when looking to buy something online. To find something locally, many consumers go to Yelp, which performs 12.5 million queries per week.

The figures below, from Google’s trial exhibit, reveal Google shows it faces significant competition for individual types of searches, like finding local businesses and shopping. In local search, users go to Yelp more than Google. And to shop, Amazon is nearly as popular as Google.

This diversity in search options is a strength of the market. Each search engine, or each platform integrated with search, has a set of features most desirable to some users for some activities. This reality contrasts with the DOJ’s insufficiently broad view of searches, which results from specialized search engines are in some way different from those from general search engines. The Justice Department refuses to see them as market competitors, even though Google is clearly competing with them for users—and sometimes losing.

There are newer forms of search that are also reducing Google’s market share. In a Google presentation dated August 2021, Google staff analyzed survey data about TikTok users and their search behaviors. Instead of searching for a news article on an event using Google, users increasingly searched TikTok for a video that explained it in a short, engaging way. Google found that in 37% of user-reported searches, TikTok was the primary search engine, and 28% of TikTok users said TikTok meets most or all their daily search needs.

With this more complete understanding of the search market, it’s clear Google has significant competition. Consumers use specialized vertical providers to find products or services in direct competition with Google. Failure by the courts to adopt a proper understanding of relevant markets puts high-quality, popular products like Google’s search engine at risk while inviting further government intervention.