At this past summer’s Transportation Research Board (TRB) automated vehicles conference, I was asked to examine how automated vehicles (AVs) could affect short distance intercity travel modes, particularly short-haul aviation, high-speed rail, and intercity buses. While fully automated vehicles are years away, partially autonomous vehicles could operate relatively soon operate on intercity routes, improving productivity on short-haul trips.

For this exercise, I’m estimating a level 4 autonomous vehicle — where the car can perform all tasks itself. I defined short-distance intercity travel mode as any one-way trip up to 500 miles. I used the most recent data from the Bureau of Transportation Statistics (BTS) Intercity Travel Survey, supplemented with more recent data and extrapolated to 2019. (BTS no longer conducts the intercity travel survey and no other survey is as effective).

Travel distance is understandably a big factor in mode choice. For trips of 150 miles or less, auto mode share is 97 percent, aviation’s share is 0.2 percent, buses represent 1.6 percent and trains have a share of 0.9 percent.

For medium-distance trips (500 to 1,000 miles each way) no mode is quite as dominant with cars at 54 percent and aviation at 42 percent splitting the vast majority while buses get 2.6 percent and trains get 0.9 percent again.

For trips of more than 1,000 miles, aviation is dominant with 75 percent of the mode share, followed by cars at 23 percent, buses at 1.4 percent and trains at 0.8 percent.

For all intercity travel, cars are dominant, with a 90 percent share, aviation’s share is 7 percent, buses earn 2 percent and rail’s share is less than 1 percent.

More than half of all intercity trips (56 percent) were for pleasure, with only 16 percent for work trips.

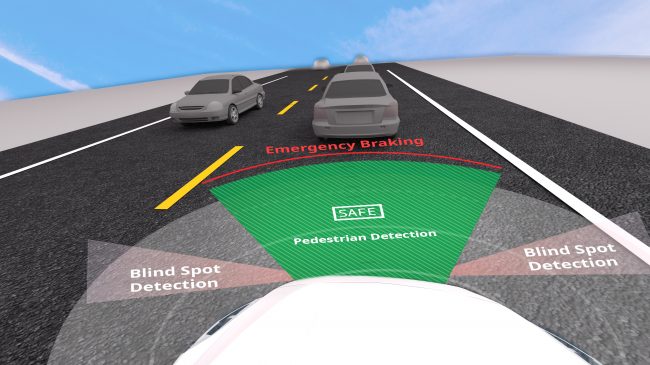

In order to determine how many travelers would switch travel modes, we have to consider their productivity in automobiles. Business travelers value productivity, so they are more likely to choose a faster travel mode (plane versus cars, for example). However, business travelers who fly are more likely to switch to automated vehicles (AVs) if AVs can help improve their productivity. Since one major advantage of automated vehicles, compared with conventional vehicles, is the ability for business travelers to work the entire trip — since they can read, be on the phone, etc, and don’t have to drive the vehicle —they are likely to consider switching modes.

But determining how many travelers will switch to AVs relies on external factors, including fleet turnover. Will there be sufficient automated vehicles available, particularly since early AVs will be shared? How many travelers will share one vehicle? What will the costs be? Will all major arterials be able to accommodate AVs? Will pavement quality and line markings become updated since AVs use them to navigate and thus they become more important in the future? Finally, is the trip substitutable?

Consider that Atlanta to Orlando is one of the top air routes today. Yet, the difference in travel time (in uncongested conditions) is less than 2 hours (4.5 hours for air including driving to the airport, going through security, etc, compared to approximately 6.25 hours for driving). It might be a trip that air travelers consider shifting to AVs.

Meanwhile, New York to Los Angeles is another top aviation trip, yet those travelers are very unlikely to take the multi-day car trip needed to get between the two metro areas.

According to BTS, 193.3 million intercity travelers fly. Of those, based on the factors outlined above, I estimate that approximately 10 percent could switch modes to AVs. Approximately 21.1 million intercity travelers take rail. In this case, I estimate up to 80 percent could consider switching. More than 55.4 million take bus and 70 percent of those could switch to AVs. Finally, there are approximately 2.3 billion intercity auto travelers. While many auto travelers would switch from conventional to autonomous vehicles, they would still travel on highways so that demand would not change. (If more people choose to ride together in AVs, that would reduce vehicles and trips). In total, I estimate that 77 million travelers could switch from aviation, rail and bus to automated vehicles.

In some cases, the switch to automated vehicles offers clear benefits to travelers and society. Other cases are more nuanced. In aviation, airlines have ended most of their short-haul (less than 500 miles) service because it is largely unprofitable. From their peaks, airlines have also reduced small-city destinations by 60 percent, service by 50 percent and the number of regional airplanes flown by up to 80 percent. If AVs were gaining shares of short- and medium-distance air travelers, airlines might be able to add flights to in-demand cities and use the gates that get freed up by the elimination of some short-haul routes. The primary negative in terms of aviation would be the potential loss of travel options as airlines sort out which cities and routes are less profitable in the era of AVs.

If rail were to lose a significant share to AVs, taxpayers might reconsider subsidies. For example, only two of Amtrak’s 33 lines are profitable from an operational perspective and all lines lose money when factoring in guideway costs. Removing those subsidies could, theoretically, reduce government spending, deficits, and debt. The biggest negative AVs would have relative to rail would be in major urban areas, where it might be much harder to access key city centers via AVs compared to rail.

Automated vehicles’ impact on the intercity bus routes and service would be more complicated. Bus riders’ average income is lower than air or rail travelers. As a result, it is not clear that those travelers would switch modes. Buses require little if any subsidies, so there are no taxpayer savings from switching modes. Finally, a mostly full bus uses less road space than 10 two- or three-person person AVs.

Clearly, this analysis is an outline and has some limitations. First, it does not include future technological improvements. Sudden improvements could make air travel cheaper or train travel cost-effective (in theory).

Second, while it takes the willingness to pay into account, predicting human behavior is very challenging. Early managed lane models assumed that workers making $25 an hour would gladly pay $5 to save an hour of travel time. But researchers learned that many of those workers would not use the toll lanes, either out of financial need, dislike for tolls, or simply because they didn’t think it was worth the price. Similarly, we may learn tha people who might benefit from switching modes of travel may resist doing so, even if it appears to be in their financial interest to do so.

Third, the data are several years old and incomplete. We know that intercity bus ridership has increased over the past 10 years. And the data do not include ridership numbers for every bus line.

Predicting future transportation trends and major shifts in travel patterns is always challenging In the short-term, policymakers don’t need to take any drastic steps to account for changes in travel behavior that may come with AVs. But given that auto traffic will likely increase while short-haul train and air travel likely decrease, policymakers should be cautious when considering major expansions to airports that are not already congested or building new rail lines. Finally, cities may want to encourage designated pick-up areas for travelers looking to share level 4 automated vehicles once they become feasible.