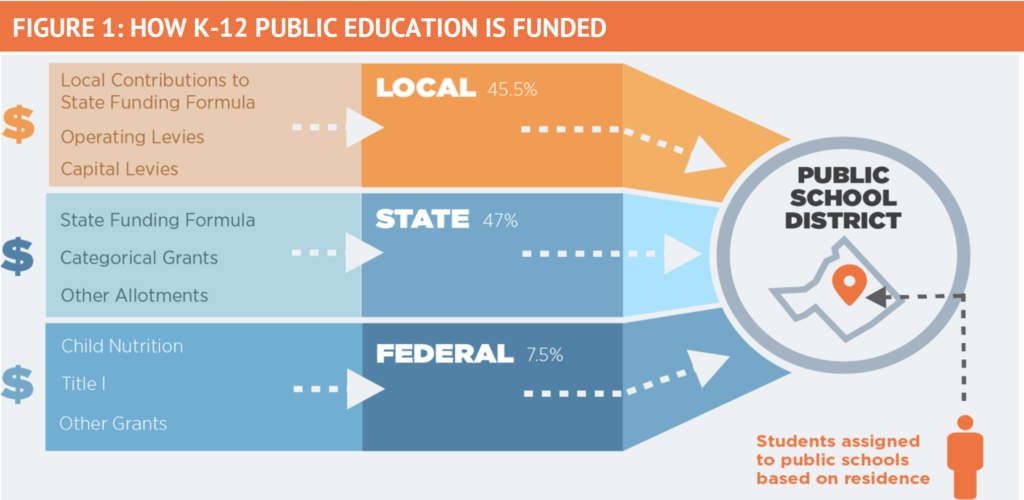

Funding for K-12 public education is a shared responsibility between federal, state, and local governments. Figure 1 provides a snapshot of these revenue sources in the 2019– 2020 school year.

State policymakers have little say over how federal education dollars are allocated and used, so this policy brief focuses exclusively on state and local funding.

While school finance systems vary considerably across states, school districts generally rely on four distinct revenue streams that can be broadly categorized as follows:

State Funding Formula Aid is a state’s primary method of delivering education dollars to school districts. A combination of state and local dollars fund most state formulas through a foundation program. Arizona, for example, employs a funding formula where each student receives $4,775.27, using weights to augment that funding for students with greater needs. Additionally, each school district in the state is assumed to tax at a certain rate locally to contribute toward that per-student amount, with the state filling in the gaps when districts can’t cover the full amount locally.

Outside-the-Formula State Aid are allotments that often come in the form of restricted-use grants for specific purposes such as reading intervention, textbooks, and staffing positions. These are funded exclusively by the state. Continuing with the example of Arizona, the state allocates various grants outside of its core formula for items like school safety and teacher salary increases.

Local Operating Levies are local education dollars raised by school districts to support operating expenses such as teacher salaries, classroom supplies, and routine maintenance. These often require voter approval, but school boards sometimes have the discretion to determine levy amounts within set limits. Georgia, for instance, allows school district boards to levy local property taxes above and beyond their formula contribution to support school operations.

Local Capital Levies are local education dollars raised by school districts to support capital expenses such as construction, equipment, and building improvements. These usually require voter approval and are often used to pay off bonded debt.

Importantly, every state education funding formula is heavily based on school district enrollment. While states vary on how enrollment-sensitive their funding systems are, overall, school districts in every state generally gain or lose funds when enrollment increases or decreases, all else being equal.

This column is an excerpt from Public Education Funding Without Boundaries: How to Get K-12 Dollars to Follow Open Enrollment Students