In my researching the wireless competitive picture for my comments on the FCC Network Neutrality NPRM, one of my contacts was kind enough to point me to a Bank of America/Merrill Lynch paper that used the Herfindahl-Hirschman Index (HHI) to compare the market concentration of wireless service providers in the 26 Organization for Economic Co-Operation and Development (OECD) countries. HHI is one of the metrics used by the Department of Justice to determine market concentration. It is calculated by squaring the market share of each firm competing in the market and then summing the resulting numbers. For example, for a market consisting of four firms with shares of 30, 30, 20, 20 percent, the HHI is 2600 (302 + 302 + 202 + 202 = 2600). The higher the number, the greater the market concentration. When the formula is applied to the U.S. wireless market share percentages determined by Bank of America/Merrill Lynch (28.5, 26.7, 18.2. 12.1 and 14.5), the U.S. HHI is the smallest at 2213. This number is substantially less than the HHIs for all the other OECD companies with the exception of the U.K. Otherwise, no other HHI is under 2900.

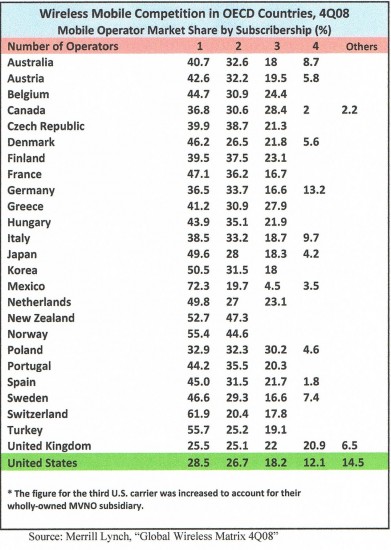

Here’s the OECD market share data for Q4 2007 as it appears in the Bank of America/Merrill Lynch’s Global Wireless Matrix.

Based on the HHIs derived from this data, here’s how OECD countries rank going from least concentrated to most concentrated.

Country HHI

| U.S. | 2213.04 |

| U.K. | 2243.32 |

| Germany | 2917.74 |

| Italy | 3028.27 |

| Poland | 3058.9 |

| Canada | 3106 |

| Australia | 3118.94 |

| Austria | 3265.49 |

| Denmark | 3343.29 |

| Sweden | 3360.37 |

| Greece | 3430.66 |

| Spain | 3491.38 |

| Finland | 3500.11 |

| Czech Rep. | 3543.39 |

| Belguim | 3548.26 |

| Japan | 3596.69 |

| Portugal | 3625.98 |

| Hungary | 3638.83 |

| Netherlands | 3742.65 |

| France | 3807.74 |

| Korea | 3866.5 |

| Turkey | 4102.34 |

| Switzerland | 4564.61 |

| New Zealand | 5014.58 |

| Norway | 5058.32 |

| Mexico | 5647.88 |

I used some examples in my comments, although I refrained from showing the data from all 26 countries. However, I thought it would be interesting to post, simply because the case for network neutrality is based on the false premise that U.S. service providers are consolidating into fewer and fewer companies. Second, many of the advocates of Internet regulation ironically point to Europe and Asia as the model for better competition, when, in truth, it is in these markets are far more concentrated.