As policymakers across the U.S. look to modernize school finance systems a fundamental question must be addressed: Are local revenues compatible with student-centered funding? The failure of state-aid systems to address the funding inequities caused by local revenues have been highlighted since at least 1906 when Stanford University’s Ellwood P. Cubberly observed that “Justice and equity demand a rearrangement of the apportionment plan so as to place a larger portion of aid where it is most needed.” Despite nearly a century of reforms aimed at neutralizing the effects of local revenues in school finance systems, horizontal funding-equity—the idea that students with identical needs should receive the same level of funding regardless of where they reside within a state—remains an elusive goal as district boundaries still determine the level of resources that students receive.

In a majority of states the highest-spending districts dole out about twice as much per pupil as the lowest-spending districts, and in some cases students in high-poverty districts are shortchanged as states such as Pennsylvania and New York allocate more state and local dollars to lower-poverty districts. Two primary factors contribute to these inequities.

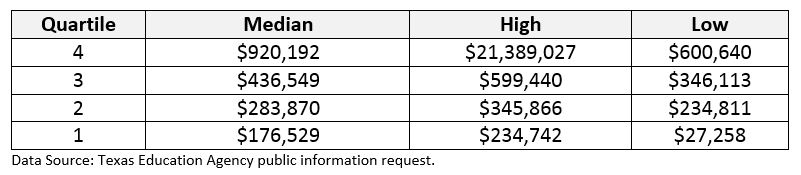

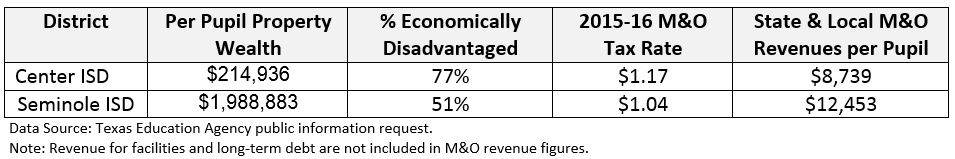

First, district boundaries result in varying access to taxable property wealth with which to raise local revenues. For example, in Texas the median district in the wealthiest quartile has more than five times greater per-pupil property wealth than the median district in the poorest quartile as shown in Table 1. This means that absent state equalization formulas, a dollar of local tax effort for the property-wealthy district raises $9,201 per pupil while the same effort only yields $1,755 per pupil for the property-poor district. When two districts in these respective wealth quartiles are examined it is clear that the property-poor district, Center ISD, receives substantially fewer state and local dollars despite levying a higher tax rate and having a greater concentration of low-income students than Seminole ISD. This is symptomatic of the so-called “Traditional School Finance Problem,” which is characterized by high spending and low tax rates for property wealthy districts and low spending and high tax rates for property poor districts. These figures are displayed in Table 2.

Table 1: Texas Property Wealth per Pupil by Quartile

Table 2: District Comparison

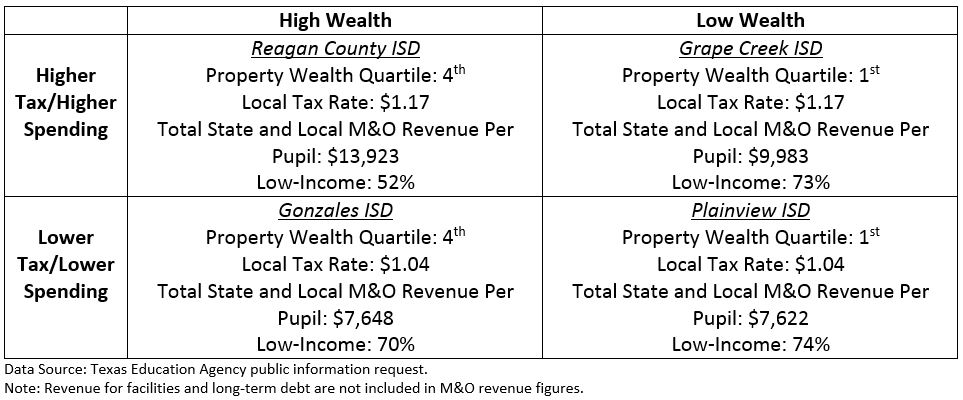

Additionally, local tax policies also contribute to inequities. It is likely that variations in local tax rates are influenced by demographic and socioeconomic factors, and horizontal equity can be elusive even among districts with identical tax bases. For example, Table 3 shows how local tax rates can cause districts with similar property wealth to raise vastly different revenue levels in Texas. Grape Creek ISD is in the same wealth quartile as Plainview ISD yet taxes at a substantially higher rate and raises $2,361 more in per pupil operating revenue, and a similar dynamic is observed between the property wealthy districts Reagan ISD and Gonzales ISD. It’s important to note that such variations are also observed among districts at the county level, where operating costs are more comparable and districts must compete for scarce human capital. As Bruce Baker of Rutgers University concludes, “The power of state school finance systems to resolve inequities in funding across local districts is limited. Local district and municipal taxing and spending decisions can—and, in many cases, do—undermine state school finance policy objectives.”

Table 3: Property Wealth, Tax Effort and Spending

Other aspects of school finance formulas further undermine equity. For example, minimum aid provisions divert state dollars to districts that need them least and hold-harmless clauses favor some districts over others by basing funding levels on historical spending patterns. Also problematic are state funding streams that are distributed outside of general aid formulas and fail to account for local tax bases. While these allocations are often based on student populations such as low-income—a desirable feature—the fact that they aren’t included in the base formula means that state funds are sometimes ‘piled on’ to affluent districts that already raise large sums of foundation revenue.

Although school finance equalization mechanisms help close funding disparities the fact remains that they were never designed to promote student-level equity. Most states use some form of a foundation formula, which is intended to provide districts with a per-pupil funding floor and generally allows for large variations in local add-ons. And Guaranteed Tax Base (GTB) programs that were developed in the early 1970s in response to school finance litigation promote a form of taxpayer equity that can still result in large discrepancies. While some might contend that equalizing districts’ ability to raise revenue is sufficient, this is not the same thing as equalizing funding for students. GTB programs also lower the economic price for districts to raise revenue thereby incentivizing some to spend more than they otherwise would, which can lead to a so-called “New School Finance Problem”: low-wealth districts with low tax rates and expenditures, and high-wealth districts with high tax rates and expenditures.

But funding inequities are not the only problem caused by local revenues. As school choice policies such as inter-district transfers, charters and education savings accounts redefine the meaning of ‘local control,’ it’s becoming increasingly clear that local revenues erect barriers to portability and transparency. For example, California’s basic aid districts—property wealthy districts that are almost entirely locally financed—aren’t incentivized to accept out-of-district transfer students who might benefit from their schools. According to Paul Reed, deputy superintendent and chief business official of Newport-Mesa Unified, “There are folks unhappy they can’t go to school here, and I feel sorry for them, but on the other hand their taxes aren’t supporting education in this community.” In a system dependent on local revenues this type of sentiment is largely unavoidable as families who want better options are made into free riders and district officials and taxpayers are incentivized to protect their turf against them.

To be sure, virtually every state can drastically improve equity and portability within the confines of existing revenue sources and policymakers should continue to seek such changes as about 45% of U.S. education dollars are currently raised locally (mostly from property taxes). However, it is clear that local revenues are incompatible with student-centered funding and education systems would benefit from ending this reliance altogether. While this wouldn’t automatically erase all inequities and portability problems in the short-term—political realities and the sheer complexity of most systems would help maintain deeply entrenched inefficiencies— it would lay the foundation for systemic long-term changes that truly put students first. This might sound like a lofty goal, but a workable proposal to help Pennsylvania take this leap has gained serious momentum.

Last week a bi-partisan group of twenty legislators introduced the Property Tax Independence Act, which seeks to tax replace property dollars with a combination of state sales and income tax revenue. Notably, the Pennsylvania Independent Fiscal Office found that a previous version of the bill would be financially viable with only minor adjustments. Backed by the Pennsylvania Coalition of Taxpayer Associations, a nonpartisan organization of over 80 member groups, it took a tie-breaking vote by the state’s lieutenant governor to defeat the bill in the Senate in 2015. However, its primary sponsor Sen. David Argall believes there’s reason to be optimistic about its chances in the current session.

A forthcoming Reason Foundation policy brief will further explore the role of local revenues in funding public education. But first, join us on July 17th in Baltimore for the Future of Education Finance Summit, which will include a presentation on this topic entitled School Finance Reform and Local Revenues. Ron Boltz, a former school board member and grassroots activist with the Pennsylvania Coalition of Taxpayer Associations, will be on hand to share their story and answer important questions about the benefits, challenges and feasibility of transitioning to a full-state funding model.