- Reforming the passenger facility charge

- Secondary cockpit barriers back on the agenda

- Denver post-mortem reveals flawed terminal P3 process

- New York airspace still a mess

- News Notes

- Quotable Quotes

Reforming the Passenger Facility Charge to Support Aviation Recovery

By Marc Scribner

The COVID-19 pandemic and responses to it injected an unprecedented amount of uncertainty into the air travel market. Nearly overnight, year-over-year passenger boardings in the U.S. cratered by 95%. Aviation and travel industry analysts were predicting recovery time horizons of four or more years, but domestic air travel demand came roaring back to almost pre-pandemic levels after less than two years.

This surging demand caught the industry by surprise and has led to deteriorating airline network conditions and airport overcrowding. With respect to airports, commercial hubs are trying to adjust to new conditions but are hindered by outdated funding and financing mechanisms. A new policy brief from Reason Foundation makes the case for modernizing one such mechanism, the passenger facility charge (PFC), to give airports additional flexibility to respond to rapidly evolving air travel patterns.

Like the airlines, airports received tens of billions of dollars in taxpayer support during the worst of the pandemic. To restore airport self-sufficiency, giving airports maximum operational and financing flexibility to adjust to emerging conditions is critical to minimizing the costs and disruptions associated with aviation recovery. Reforming the PFC is one important step Congress can take in supporting this goal.

The passenger facility charge is a congressionally authorized, federally regulated, local airport user fee. It exists alongside the federal Airport Improvement Program (AIP), a grant program funded through the Airport and Airways Trust Fund by a variety of aviation taxes. Together, the PFC and AIP have historically accounted for roughly half of the total airport funding available for capital projects, according to the Congressional Budget Office.

The federal PFC cap was last raised by Congress in 2000. Under current law, public airports in the United States can charge a maximum PFC of $4.50 per boarding for the first two flight segments of a trip, with PFC collections per passenger being capped at $9 per one-way and $18 per round-trip. Thanks to inflation, the passenger facility charge has seen its purchasing power plummet by approximately half, negatively impacting airports’ ability to address their growing list of needed improvements.

Due to restrictions on use, Airport Improvement Program funds tend to support airside projects such as runways, taxiways, aprons, and noise abatement. In contrast, PFC revenue has fewer restrictions and tends to support landside projects such as passenger terminals. Importantly, unlike AIP funds, PFC funds can be used to service debt, which allows airports to long-term finance rather than merely fund improvements. These differences in flexibility have led to a strong preference for the PFC over AIP at commercial airports with sizeable passenger volumes.

The flexibility of the PFC vis-à-vis AIP also has consequences for airport productivity. Recent empirical research has found that increasing airport reliance on PFC revenue while decreasing airport reliance on AIP revenue increases airport efficiency. This enhanced productivity is thought by researchers to be the result of the PFC being available to finance a wider array of airport projects than AIP funding, which allows airports to better prioritize and undertake projects with greater returns on investment. The implication is that leaving the PFC cap at the current $4.50 while increasing AIP funding would have a negative airport efficiency impact.

Some opponents of PFC reform have argued that airports should rely more on non-aeronautical revenue as a substitute for raising or eliminating the PFC cap. While airports seek revenue opportunities from terminal concessions, Federal Aviation Administration (FAA) data from during the pandemic demonstrates that other non-aeronautical revenue sources generally carried greater revenue risk than the PFC.

The COVID-19 pandemic had varying impacts on non-aeronautical revenue sources. Between 2019 and 2021, the declines in PFC revenue and parking revenue were similar to the 44.75% drop in enplanements at commercial service airports. Restaurant and retail revenue declines were steeper than PFC and parking revenue declines, likely reflecting less time spent at the airport by those who did travel by air, concerns about crowding and ventilation, and masking. Rental car revenue fared better, with less-severe declines likely the result of a shift away from shared ground transportation (ride-hail, taxi, mass transit) and new demand from some arriving passengers for rental cars for trips that would formerly have been completed by a connecting flight.

While PFC revenue, like non-aeronautical operating revenue, depends on the demand for passenger airline service, it does not face additional risks from ground transportation modal substitution. As air travel recovers in general, so too should PFC revenue. In contrast, parking and rental car revenue are likely to be less reliable due to renewed competition from ride-hailing, which is likely to result in a net reduction in ground transportation airport revenue.

Aside from its fiscal purpose, the passenger facility charge was also designed to enhance airline competition and promote lower airfares. In the 1950s and 1960s, in exchange for airlines committing to rents and other fees to service existing airport debt and other financing arrangements, many airports granted incumbent airlines long-term exclusive-use gate leases. This led to a paucity of gates being available for new carrier entrants. Economists have estimated that annual airfares are $5.81 billion higher in 2019 dollars than they would be with adequate gate access to support new carrier entrants at large and mid-sized airports. This figure dwarfs the $3.51 billion in nationwide PFC collections in 2019.

Further expanding the passenger facility charge’s purchasing power by focusing on improving airline competition through eliminating the statutory cap—especially through expanding common-use gates available to new carrier entrants—could result in substantial fare savings for consumers. These savings could more than counteract the modest negative marginal impact on travel demand of increased PFCs, especially if airline ancillary fees on seats, baggage, and other previously bundled services were to be included in the full-price unit of analysis.

As Congress debates FAA reauthorization next year, it should consider modernizing the passenger facility charge as a pro-consumer method of restoring commercial airports to self-sufficiency in the post-pandemic aviation environment. To maximize the fairness and efficiency of PFC reform, Congress should eliminate the statutory cap on passenger facility charge collections while simultaneously requiring any airport that opts to charge a PFC more than the current $4.50 maximum to forgo 100% of its AIP funding. The annual AIP funding authorization can then be proportionately reduced, which would save federal taxpayers hundreds of millions of dollars per year.

Secondary Cockpit Barriers: Back on the Agenda

Back in the 2018 FAA reauthorization bill, Congress mandated that FAA develop a regulation requiring airlines to add a secondary barrier between the front lavatory, adjacent to the cockpit, and the front passenger cabin. The idea was that the barrier would be extended whenever the cockpit door needed to be opened in flight, to prevent a would-be attacker from jumping over the service cart positioned in the aisle to gain access to the cockpit.

FAA convened an aviation rulemaking advisory committee, a standard practice, to gather input from stakeholders, including airlines, aircraft manufacturers, pilots, and technical experts. That committee’s 2020 report laid out how this could be carried out. Presumably due in part to the disruption caused by the COVID-19 pandemic, it was only this July that FAA issued a Notice of Proposed Rulemaking (NPRM). Needless to say, the Air Line Pilots Association (ALPA) welcomed the NPRM as long overdue.

Three main airline trade associations that have long opposed secondary barriers as unnecessary asked for a 60-day extension of the time for submitting comments. And a coalition of aircraft manufacturers, including Airbus and Boeing, submitted their own request for a 60-day extension. Both groups complained about the complexity of the issue and the need to assemble technical experts, etc. On Sept. 8, FAA dismissed these complaints, pointing out that the NPRM is consistent with the published report from 2020 and therefore that “sufficient time has passed” for commenters to prepare their submissions.

As it is, the proposal is a compromise. It would not require retrofitting secondary barriers on any existing airliners. It would apply only to aircraft produced and put into service two years or more after the final rule’s release. It would only apply to passenger airlines certified to operate under Part 121. And it would apply only to U.S. airlines.

Those limitations would certainly reduce the benefits of the regulation, which would add a modest increase in cockpit security even if retrofitted to all aircraft. Still, as I have written previously on this issue, a secondary barrier is a one-time expense, as were the original hardened cockpit doors required to be retrofitted to all in-service airliners. The big cost is in the ongoing expense of federal air marshals (FAMs) who must ride in the front cabin (on the few flights they actually appear on), adding $1 billion a year to the Transportation Security Administration’s budget paid for by taxpayers and depriving airlines of the usually higher revenue from two front-cabin seats.

In a recent paper, “Security Risk and Cost-Benefit Analysis of Secondary Flight Deck Barriers,” noted researchers Mark Stewart and John Mueller estimated potential risk reduction from secondary barriers at 8.2% and compared this to the annualized cost of the one-time upgrade. The resulting benefit/cost ratio is a very high 41. In their 2018 book, Are We Safe Enough?, Stewart and Mueller found the benefit/cost ratio of the federal air marshals program to be only 0.03—i.e., each dollar spent on FAMs yields only three cents worth of benefits, whereas each dollar spent on secondary barriers yields $41 worth of benefits. Stewart tells me they are preparing a submission in response to the NPRM.

The airlines would have a much stronger case if they called for the elimination of the costly and ineffective federal air marshals program and in exchange agreed to secondary barriers on new planes.

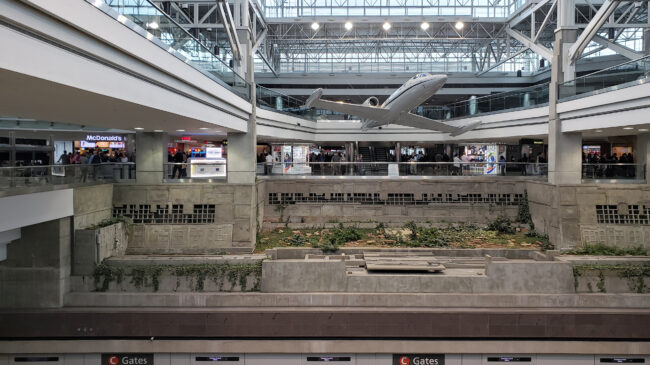

Denver Post-Mortem Reveals Very Flawed Terminal P3 Process

Last month, Denver International Airport released its “Great Hall After-Action Report,” attempting to explain how its $1.8 billion long-term public-private partnership (P3) to expand and modernize the Jeppesen Terminal at Denver International went off the rails. While airport management is to be commended for assessing what went wrong, the report reveals that in selecting a long-term public-private partnership and trying to manage it as the private provider’s partner, they had a very poor understanding of this kind of P3.

While airport public-private partnerships are far more common in Europe, Latin America, and Australia than in the United States, they have been used quite a bit in this country for highway (and a few rail transit) projects, including in Colorado. The state transportation agency’s P3 unit, recently renamed the Colorado Transportation Investment Office—CTIO, has done several long-term design/build/finance/operate/maintain (DBFOM) P3s, including a major reconstruction of I-70 between the airport and downtown Denver. The airport’s management could have learned a lot from CTIO’s experience, but their after-action report reveals basic misunderstandings.

First of all, the process Denver International followed to decide whether a DBFOM P3 was superior to in-house management (generally as design-bid-build or design-build) was unusual. The normal process is to define the best-case conventional approach (called the Public Sector Comparator—PSC) and then estimate how a long-term P3 would compare, using something called a value for money (VfM) analysis. Many guides are available on how to do a VfM, including from the U.S. Department of Transportation, consulting firms, and Colorado Department of Transportation (CDOT).

A key aspect of the VfM is identifying and quantifying the expected risk transfers from the public sector to the P3 company. Such risks include revenue (if the project is financed based on project revenues), construction cost overruns, late completion, and also “competitive neutrality.” That term refers to estimating the dollar value of differences between the public agency and the P3 company, such as that the company pays for insurance whereas the agency self-insures via the taxpayers, and that if the company succeeds in making a profit over the long term of the agreement, it will generate corporate income tax revenue for the state.

The actual VfM study does not appear in the report, but the description on pp. 32-33 is very general. Its risk allocation table incredibly shows “change orders” being the public sector’s responsibility. What is also very strange is the report says the DBFOM P3 and the three conventional methods came out about the same, which reinforces my concern about a faulty VfM analysis. (I suspect it was qualitative, not quantitative.) Yet DEN should have known how to do a serious VfM. The overall report makes several references to the Colorado Department of Transportation’s Central 70 project, done as a DBFOM P3. CDOT’s detailed VfM analysis is readily available, but it’s difficult to imagine how DIA’s VfM could have been so poor if they had followed the process CDOT went through.

Another departure from normal was DEN’s failure to carry out a competitive procurement process. This usually includes issuing a request for qualifications, selecting the best, typically three, teams that responded, sending them a draft request for proposals (RFP), revising and then issuing the RFP, and selecting the best-value proposal as the basis for negotiating a long-term agreement. Instead, Denver International just held informal discussions with several companies and then decided to negotiate with Ferrovial. That company has solid airport P3 experience, but it had not done an airport project in the United States. A normal P3 procurement process might have led to a different team and a better-focused agreement.

As was widely reported when the agreement was terminated in 2019, the reason was neither “for cause” nor “for convenience.” It was the growing recognition on both sides that the relationship was not working, in part because the roles and responsibilities of the public and private partners were not well-defined or agreed to in writing, which led to all kinds of problems. As the report says, in a long-term P3, “The owner needs to understand, and accept, the limitations on their decision-making and management authority.” Given the shared problems, DEN and Ferrovial negotiated a $184 million termination payment to the company.

Fortunately, the report concludes by acknowledging that Denver’s experience does not mean long-term public-private partnerships are a bad idea for airport terminal projects. It points to the successful completion of LaGuardia’s $4 billion Terminal B replacement, for example, which opened in July pretty much on time.

New York Airspace Still a Mess

An Aug. 16 article in Government Executive was headlined “FAA-Caused Flight Delays in New York Preview Potential ‘Crisis’ in Coming Years.” It focused on ground delays caused by air traffic controller staff shortages that have led to and continue to lead to delayed traffic in and out of Newark Liberty International Airport (EWR), John F. Kennedy International (JFK), and LaGuardia Airport (LGA). Controllers’ union president Rich Santa, in a July speech at the Aero Club of Washington, pointed out that FAA temporarily closed its training academy during the COVID-19 pandemic, just as it did in 2013 during the sequester that shut down large parts of the federal government. FAA does plan to hire 1,500 more air traffic controllers this year, but the majority of them will spend several years in training before being fully qualified to control traffic.

At any rate, a controller shortage is not the only problem that has made the New York metro area the site of far more ongoing delays than anywhere else in the country. One reason for this is the complex airspace, in which the three major airports, along with smaller ones like Teterboro and Westchester, have approach and departure paths that are difficult under the best circumstances but can conflict when weather forces runways at an airport to shift direction.

If you’ve been following FAA air traffic improvement programs for the past two decades, you may recall a big one called Metroplex. The aim was to identify major metro areas with multiple airports and complex airspace and apply new technology and procedures to streamline traffic flow. On the FAA website you can find a list of the Metroplex Airspace Locations:

- Atlanta

- Charlotte

- Cleveland-Detroit

- Denver

- Houston

- North Texas

- Northern California

- South Central Florida

- Southern California

- Washington, DC

Conspicuously absent from this list is the New York-New Jersey area. Further exploration at FAA.gov reveals a page labeled “New York/New Jersey/Philadelphia Airspace Redesign,” dated Dec. 30, 2020. It explains that this project was intended:

“…to increase the efficiency and reliability of the airspace structure and the Air Traffic Control (ATC) system, thereby accommodating growth while enhancing safety and reducing delays…While four stages of implementation were originally planned, FAA paused the project in 2012 in light of air transportation system changes in the intervening years. While several beneficial elements of the project were implemented, the National Airspace System evolved significantly between the 2007 EIS [Environmental Impact Statement] and 2012. New NextGen capabilities such as Time-Based Metering and advanced satellite-based navigation procedures, increasing consolidation of the airline industry, changes in system use, and evolving traffic patterns resulted in new and different airspace and procedures requirements. As a result, the FAA suspended the project in May 2013…There are no current plans for further work of the project.”

Every one of those changes affected the entire air traffic control system, not just New York. That mumbo-jumbo explains nothing about why New York was left out of the Metroplex program. People I asked about this years ago rolled their eyes. Their general assessment was that the politics and likely environmental opposition to any changes in flight paths in that region were likely to be so fierce that it would be deemed to be a losing battle. And that’s one of the reasons why the New York/New Jersey/Philadelphia airspace remains to this day, and will continue to be, the cause of about 40% of all U.S. air traffic delays.

First U.S. Mainland Airport P3 Lease Agreed

Last month, the Tweed New Haven Airport Authority approved a 43-year public-private-partnership (P3) lease with airport operator Avports, backed by a Goldman Sachs infrastructure investment fund. This is a revenue-risk concession, under which Avports/Goldman Sachs will lengthen the runway, build a new terminal on the east side of the airport, and operate and manage the airport. Thanks to this agreement airport subsidies from the city and state will be eliminated. The only other U.S. whole-airport P3 lease is San Juan International in Puerto Rico, dating to 2013.

Vinci Airports Had a Great Summer

On Aug. 1, Vinci Airports announced its purchase of a 29.99% stake in OMA, the company that operates 13 airports in northern and central Mexico. Vinci purchased the shares from shareholders SETA and Aerodrome. On Sept. 5, Vinci Airports signed a 40-year P3 agreement to operate four international airports in Cape Verde, Africa. Vinci will modernize the airports as well as operate and manage them. And on Sept. 10, Vinci Airports was selected as the preferred bidder for the Tahiti Airport, the largest airport in French Polynesia. Vinci now operates more than 50 airports worldwide, according to Inframation News.

Aena Wins Big in Brazil Airport Auction

In Brazil’s seventh round of airport asset recycling, Spanish airport operator Aena was the biggest winner, acquiring P3 leases of 11 airports in several states, the largest of which is Congonhas Airport in Sao Paulo. The other airports are in Mato Grosso do Sul, Para, and Minas Gerais. Winning a second set of airports was a joint venture of Socicam and construction company Dix, leasing the airports in Belem and Macapa. Asset management firm XP Asset won the concession for a set of general aviation airports. All three concessions are for 30 years.

LaGuardia Terminal B P3 Opens on Time

The $4 billion P3 that rebuilt and expanded LaGuardia’s formerly shabby Terminal B was declared operational in late July. All but two of the terminal’s 35 gates opened in January. The P3 company LaGuardia Gateway Partners will operate and manage the terminal for 35 years under the long-term agreement. LGP consists of Vantage Airport Group, Meridiam Infrastructure, and Skanska. The project was the 2021 winner of UNESCO’s best new airport facility. It was also certified LEED Gold. The Port Authority of New York & New Jersey is the public-sector partner of LGP.

Ups and Downs for Boom Supersonic

Summer brought both good news and bad news for Boom Supersonic, the startup developer of a Mach 1.7 supersonic airliner. The good news was an order for 20 of the aircraft from American Airlines, backed by a non-refundable deposit. That news followed a previous order for 15 of the planes from United Airlines, earlier this year. The bad news was a front-page article in Aviation Daily (Sept. 9) headlined “Rolls-Royce Withdraws from Boom Supersonic Project.” The company had been working with Boom on jet engine studies since 2020, but the engine company provided no reasons for its decision. Boom says it will announce an engine partner “within the next few months.”

LAX and MIA Testing Anti-Drone Technology

PoliticoPro reported on the Transportation Security Administration is testing a new system that can detect, track, and identify drones at both Los Angeles International Airport and Miami International Airport. Data collected in real-time “will help TSA expand this capability to other airports in the future,” TSA said. But it said nothing about what a threatened airport can do to prevent a drone intrusion.

Questioning the COVID-19 Airline Bailouts

A new report from the Mercatus Center at George Mason University suggests, per its title, that “the 2020 bailouts left airlines, the economy, and the federal budget in worse shape than before.” It’s a well-researched report by Mercatus scholars Veronique de Rugy and Gary D. Leff, who is well-known for his aviation blog, “View from the Wing.” You can find it here.

Investors Considering Beauvais Airport

Beauvais Airport is 50 miles north of Paris, and before the pandemic, it was the tenth busiest airport in France. Its 15-year concession expires next June, so the governmental owner (SMABT) is holding talks with potential successors. Inframation News reports that interested parties include Egis, Eiffage, Aeroports de la Cote d’Azur, and Vinci Airports. Ryanair accounts for 72% of the airport’s traffic and Wizz Air for another 23%.

Frontier Expands Despite Losing Spirit

Having lost out to JetBlue on acquiring Spirit Airlines, Frontier Airlines announced the first of what may be a new round of expansions last month. Frontier first announced new international flights from Atlanta’s Hartsfield-Jackson International Airport. The new destinations are Nassau, San Salvador (El Salvador), Kingston (Jamaica), and both San Jose and Liberia (Costa Rica). They bring Frontier’s total overseas routes from Atlanta to eight. A week later Frontier announced another major expansion, adding 10 new destination cities from Phoenix Sky Harbor Airport, which ups Frontier’s nonstop destinations from Phoenix to 22.

Alabama Airport to Get New P3 Terminal

Gulf Shores, Alabama, is converting its general aviation airport—Jack Edwards Field—into a commercial service airport. On Sept. 7, the Gulf Shores Airport Authority signed a P3 agreement with TBI and Vinci Airports that will include providing a temporary passenger terminal, a permanent terminal, and other airport improvements, along with operating and managing the airport. The $3.7 million temporary terminal is to be operational by next March, while the permanent terminal design will begin when annual passengers reach 75,000 and construction will begin when enplanements reach 135,000.

San Bernardino Airport Gets TSA Screening

With long-hoped-for passenger service finally beginning last month at San Bernardino Airport, the TSA has opened a new screening checkpoint and luggage screening facility at the airport. Breeze Airways began service to San Francisco International last month, with continuation service to Provo, Utah. So far that is San Bernardino’s only passenger service.

Mexican Airport Company Adding Second Terminal at Puerto Vallarta

Grupo Aeroportuario del Pacifico (GAP) is building a second passenger terminal at Puerto Vallarta’s international airport. The new terminal will add nearly 800,000 square feet of terminal area. Including other expansion projects, GAP is spending $350 million on airport improvements.

Several Companies Pursuing Electric Taxiing

A decade ago, both L-3 Communications and Honeywell/Shafran demonstrated electric airliner taxiing, using electric motors to drive the main landing gear wheels. But the idea did not seem cost-effective to airlines then. Green Taxi acquired the L-3 technology and Honeywell/Safran is reintroducing their system as Electric Green Taxi System, given today’s concern about aircraft exhaust emissions. Green Taxi has switched to nose-wheel motors, while its competitor is sticking with main gear motors. FAA certification has not yet been obtained by either.

Aeroporti di Roma Partnering with Leonardo on Vertiports

ADR, Rome’s privatized airport company, has partnered with Leonardo to develop vertiport infrastructure for what it hopes will be Europe’s first advanced air mobility (AAM) route between Italy and France. Joining them across the border is Aeroports de la Cote d’Azur. The network is to include vertiports at the airports of Bologna and Venice, in addition to Rome. The group, now known as UrbanV, is working with eVTOL (electric vertical take-off and landing) startup Volocopter and hopes to launch its first local route—between Fiumicino Airport and the city of Rome by 2024.

SAF and Other Emission Reductions Assessed by The Economist

Under the headline, “Guilt-Free Flying,” the weekly news magazine The Economist devoted two-and-a-half pages to a serious look at the possibilities and costs of sustainable aviation fuel (SAF) as the route to a greener aviation future. It’s on the magazine’s website, from the Aug. 20 issue.

“While lifting the cap on the PFC is justifiable by looking at project inflation, airport needs, and promoting competition, it is also important that Congress consider deregulating the rate-setting. This would allow airports to set the rate of the PFC for different markets: international, transborder, domestic, and for connecting flights. This structure borrows from the successful example of the Canadian Airport Improvement Fee (AIF). For example, at Toronto Pearson, the AIF is set at C$30 for non-connecting passengers and C$6 for connecting passengers. Because non-connecting passengers will pay a higher airline fare on average than connecting passengers, this makes sense from its effect on airfares and it recognizes the role that Toronto Pearson plans as a connecting hub, thereby not excessively discouraging small-community traffic . . . . These considerations apply in the U.S. as well and could help obtain buy-in from connecting hubs and smaller communities.”

—Steve Van Beek, “Modernize the Passenger Facility Charge? Yes, with Deregulated Rate-Setting,” Voice of Steer, Sept. 13, 2022

“On CO2 emissions, solutions based on propulsion technology and SAF will barely move the needle by 2040. To meet its CO2 reduction goals, commercial air transport will have to do less flying—in addition to modernizing fleets, using SAF, ensuring enough SAF feedstock is directed to aviation, and offsetting emissions. If you want to reduce CO2 emissions in an optimal way at society’s level, you tackle aviation last. You want to decarbonize cement production and electric power plants first. Aviation will have to compete for decarbonized energy,”

—Jim Harris, Bain & Co., in Thierry Dubois, “Fly Less,” Aviation Week, April 4-17, 2022

“Bain & Co.’s Jim Harris estimates that it could cost $10 trillion to transition 100% of aviation to sustainable aviation fuel (SAF) by 2050. For what? With aviation accounting for 3% of all CO2 emissions, the benefits would be close to zero, even at 100% carbon-neutral. Recall that China alone is building hundreds more coal-fired power plants by 2030. Add more plants built by the rest of the world, and the futility seems obvious. Redirecting that $10 trillion to build nuclear power plants could reduce [the power sector’s] man-made CO2 emissions by perhaps 90%. I have no doubt that the push for aviation to adopt SAF is a fantastic engineering exercise. It’s also a massive waste of engineering talent that could be better spend advancing other avenues of research.”

—Joseph Blake, Letters to the Editor, Aviation Week, Aug. 8-28, 2022