Labor markets have changed significantly in recent years and decades. For workers, learning new skills, exploring job opportunities, and transitioning between roles is easier than ever. Increased employee mobility presents new challenges for public and private sector employers trying to recruit and retain talent.

In the public sector, many governments and agencies report they’re having trouble attracting and retaining workers.

So, how can policymakers balance fiscal responsibility while maintaining a stable and high-quality public workforce that delivers quality services to taxpayers? Is increasing retirement benefits for public workers the answer, and can that be done without increasing public pension debt?

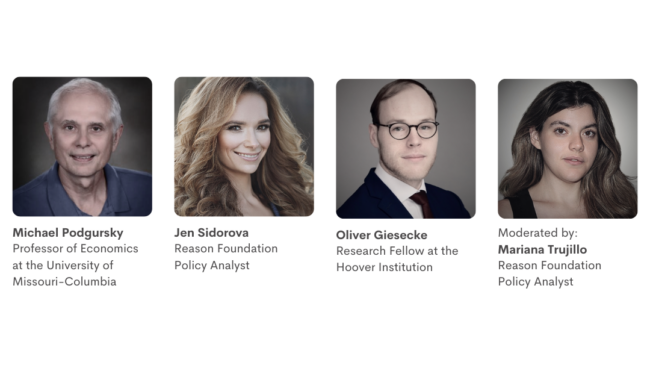

This Reason Foundation webinar examines those questions and more. The full webinar video and biographical information about the panelists are below.

Michael Podgursky, University of Missouri–Columbia

Michael Podgursky is the chancellor’s professor of economics at the University of Missouri–Columbia, where his research focuses on labor economics and the economics of education. Podgursky serves on the board of editors of several academic journals including Education Finance and Policy and Education Next, and advisory boards for various research institutes and education organizations. He also serves on the board of the Show-Me Institute, the Saint Louis Chess Club, and the Scholastic Center and is an affiliated scholar with the Center for Analysis of Longitudinal Data in Education Research at the American Institutes for Research and CESifo in Germany.

Podgursky’s body of work focuses on labor markets, teacher compensation systems, and the impacts of pension plan designs on teacher retirement and workforce quality. Some of his recent studies include: “Teacher Pension Plan Incentives, Retirement Decisions, and Workforce Quality,” which found that enhancements to traditional pension plans accelerate retirement and reduce average teacher quality by pushing high-quality teachers to retire earlier than they might prefer; and “Pensions and Late-Career Teacher Retention,” which concluded that targeted incentive policies, such as late-career salary bonuses and deferred retirement plans (DROPs), can effectively retain experienced teachers in high-need areas at relatively low costs.

Jen Sidorova, Reason Foundation

Jen Sidorova is a policy analyst with Reason Foundation’s Pension Integrity Project and a PhD candidate at Georgia Institute of Technology. She holds master of arts degrees in economics and political science from Stony Brook University. At Reason, Sidorova has contributed in-depth analysis of the Mississippi PERS, Montana PERS, Montana TRS, and North Carolina TSERS pension systems, among others.

Sidorova has been evaluating and discussing the literature on the recruitment and retention of public employees. Her recent article, “The Key to Attracting Public Workers? Pay, Not Pensions,” suggests that traditional defined-benefit retirement plans are not effective for improving recruitment or retention, especially among younger workers. She highlights that immediate compensation, job security, and work-life balance are more significant factors for modern employees. Sidorova has also been involved in analyzing Alaska’s pension system, where she showed that reinstating defined-benefit pension benefits would not improve retention or recruitment and would add significant unfunded liabilities. Her research on Alaska’s public pension system was presented at the Association for Public Policy Analysis and Management and the Association for Budgeting and Financial Management conferences.

Oliver Giesecke, Hoover Institution

Oliver Giesecke is a research fellow at the Hoover Institution at Stanford University. His work focuses on asset pricing and public finance, with recent research examining the finances of state and local governments across the United States. This includes the capital structure of state governments, the book and market equity position of city governments, and the status quo and trends of public pension obligations. He holds a PhD in finance and economics from Columbia University, a master’s in economics from the Graduate Institute in Geneva, and a bachelor of arts from Frankfurt University.

Giesecke’s research has contributed to our understanding of the financial implications of public pension systems. His recent study, “How Much Do Public Employees Value Defined Benefit versus Defined Contribution Retirement Benefits?” co-authored with Joshua Rauh, surveys public employees across the United States about their retirement plan preferences. The study finds that 89% of respondents are willing to switch from a defined benefit plan to a defined contribution plan, provided an appropriate employer contribution rate. Additionally, in his recent op-ed in The Buffalo News, titled “Why Pension Hikes Miss the Mark on Recruitment and Cost More,” Giesecke argues that increasing pension benefits is an expensive and ineffective strategy for improving public sector recruitment. He suggests that offering more flexible retirement plans and work arrangements would be more effective in retaining employees and less costly for taxpayers.

Moderated by Mariana Trujillo, Reason Foundation

Mariana Trujillo is a policy analyst at the Reason Foundation. She holds a bachelor of arts in economics from George Mason University. Before joining Reason, she worked in Treasury Market Risk at JP Morgan, the Mercatus Center, and the Cato Institute.

Trujillo’s research has examined the efficacy of common practices and beliefs in public pensions. In a recent commentary, “Public pension reforms aren’t impacting public employee turnover rates,” she demonstrates that public employee turnover rates are not accelerating at a different rate than private or statewide turnover rates. In other writings, she has explored the consequences of low pension funding, discussing how Mississippi’s faulty contributions have led to credit downgrades and writing discouraging the issuance of pension obligation bonds by Dallas to address its pension system underfunding, which was featured in The Bond Buyer.

For more information on these topics, this webinar or public pension reform, please contact Pension Integrity Project experts and subscribe to our monthly newsletter.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.