In This Issue:

Articles, Research & Spotlights

- Webinar on the Impact Public Pensions Have on Recruitment and Retention

- Paper Warns of Private Equity Dangers to Public Pension Systems

- Breaking Down Perceived Barriers to Pension Reform

- Tumult in Ohio Highlights Need for Reform, Not an Investment Slight of Hand

- Michigan Shouldn’t Divert Pension Debt Payment

News in Brief

Quotable Quotes on Pension ReformData Highlight

Contact the Pension Reform Help Desk

Articles, Research & Spotlights

Reason Foundation Webinar: How Pensions Impact the Recruitment and Retention of Public Employees

The perceived advantages public pensions bring to recruiting and retaining teachers, firefighters, police, and other public workers are often used as a justification for adopting, expanding or protecting public pension benefits. But are pensions the optimal way to attract and keep highly valued public sector employees? This recent webinar hosted by the Pension Integrity Project at Reason Foundation featuring Hoover Institution’s Oliver Giesecke, University of Missouri–Columbia’s Michael Podgursky, and Reason Foundation’s Jen Sidorova, examines the observable impact that pensions have on public employees’ behavior. Through their wide-ranging research on the subject, these experts find that a focus on long tenures makes public pensions less advantageous for securing the retirement benefits of today’s workforce and are unlikely to have much influence on the decisions of new hires the public sector hopes to attract.

Webinar Video: Experts Examine the Impact of Pensions on Recruitment and Retention

Commentary: Pension Benefits Are Not the Key to Attracting or Retaining Public Workers

Reason Foundation Policy Brief: Is Private Equity a Public Financial Hazard?

Now accounting for about 13% (and growing) of public pension investments, private equities are becoming a key part of the strategy to pull government retirement plans out of growing funding deficits. A new Reason Foundation policy brief by Larry Pollack seeks to demystify this complex asset class that is taking center stage in the pension world. Pollack also answers common questions about private equity and details the unique challenges that could surface for lawmakers and public pension plan administrators. While investment managers are hopeful that private equity will drive higher returns, higher interest rates and a general lack of transparency should give them pause. The success of many public pension systems is increasingly tied to private equity investments, so lawmakers should promote a higher level of caution and transparency.

Policy Brief: Is Private Equity a Public Financial Hazard?

Webinar Video: Answering Questions on the Impact of Private Equity on Public Pensions

Claims that Public Pension Reforms Lead to Negative Impacts Are Unfounded

With more than $1 trillion in unfunded public pension liabilities nationwide, state governments are grappling with increased annual pension costs. In many cases, states are exploring ways to slow the growth of pension debt through much-needed reforms. Making updates to the retirement promises made to public employees is often necessary, but policymakers can face challenging political headwinds fighting unfounded arguments about pension reforms. In this commentary, Reason Foundation’s Rod Crane reviews evidence and debunks claims that changing pension benefits increases liabilities, worsens employee retention, and reduces retirement security.

Ohio Teachers’ Pension Reform Shouldn’t Be Investment Hustle

In May, Ohio’s attorney general filed a lawsuit to remove two members of the State Teachers Retirement System, STRS, claiming they had breached their duty as fiduciaries. The move came after years of alleged actions to pressure the plan to contract with a newly formed—but connected—investment group promising massive results in returns through new but untested artificial intelligence strategies. As Reason Foundation’s Zachary Christensen writes in The Columbus Dispatch, this heated ordeal illustrates the dangers of an unbalanced governance board makeup, which can lead to ill-advised decisions with too little concern for the taxpayers who will ultimately foot the bill for any failed public pension moves. Ultimately, Ohio’s pension plans need reform, and long-shot investment strategies are not a substitute.

Diverting Michigan’s Pension Debt Payment Would Be Costly to Taxpayers and Put Retirees at Risk

The Michigan Public Schools Employees Retirement System, MPSERS, is still $29 billion in debt. Still, Gov. Gretchen Whitmer and legislators are now proposing diverting $630 million in annual payments away from the plan to boost other public school programs. Pointing to the actuarial modeling of MPSERS, Reason Foundation’s Ryan Frost warns that the move would add $1.4 billion in debt to a plan already struggling with burdensome interest payments, a cost that local governments and taxpayers will ultimately need to pay.

News in Brief

Understanding the Motivations of Public Sector Employees Aged 35 and Under

A recent survey by MissionSquare Research Institute explores the priorities, expectations, and satisfaction levels of public sector employees aged 35 and under. Key factors influencing their decisions to join the public sector include salary, personal satisfaction, community service, and job security. The survey reveals that most young employees found that their jobs met or exceeded their expectations in these areas. Job security, work-life balance, and health insurance emerged as top priorities for these workers. Despite generally high levels of satisfaction among this group, only 62% indicated that they intend to stay in public service long-term. The full results can be found here.

High Interest Rates Offer a Chance to Apply More Secure Assumptions

A recent brief by Allison Schrager at the Manhattan Institute posits that the current high-interest-rate environment presents a unique opportunity for the Governmental Accounting Standards Board (GASB) to mandate that public pensions use a “high-quality municipal bond rate as their discount rate,” aligning with the methodology used by private pensions for valuing retirement liabilities. Typically, this shift would be more challenging because bond rates are usually much lower than the pension system’s assumed rate of return (ARR), and a sharp reduction in assumptions would mean a drastic increase to the present value of liabilities. However, the rise in bond rates due to the current high-interest-rate environment mitigates some of this effect, creating a short window where the transition would not be as drastic as it normally would be. This move would improve pension contributions, stabilize funded ratios, and ensure long-term fiscal sustainability. The full brief can be found here.

Quotable Quotes on Pension Reform

“If we are going to adopt these changes, we have to fund them every year. That is where I am most concerned, the long-term of it. We can fund it next year, and the year after, but we have to stay the course.”

—Rhode Island General Treasurer James Diossa in “Lawmakers want modest pension adjustments to help retirees. Not so fast, general treasurer says,” Rhode Island Current, June 3, 2024.

“We’re in great financial shape right now, but I’m never going to put our law enforcement and most importantly, our state in a bad financial position…The math just didn’t add up,”

—Oklahoma Gov. Kevin Stitt on his decision to veto a pension benefit increase for police, quoted in, “Oklahoma lawmakers override veto of bill to increase police officer pension benefits” Pensions & Investments, May 30, 2024.

“Irrespective of their intended purpose, initiatives which meaningfully restrict options available for public finance and bonds or pension investments can generate significant economic effects.”

—Perryman Report, quoted in “Texas divestment over reduced oil and gas involvement could cost state hundreds of millions, report says” wfaa.com, May 31, 2024.

“It remains to be seen if these (private equity) funds will be able to exit at their target valuations or require extended holding periods in order for exits to normalize before selling.”

—Managing Director at Casey Quirk in “Asset owners favor fixed income, infrastructure, India and Japan — Casey Quirk-P&I survey” PensionsandInvestments.com, May 28, 2024.

Data Highlight

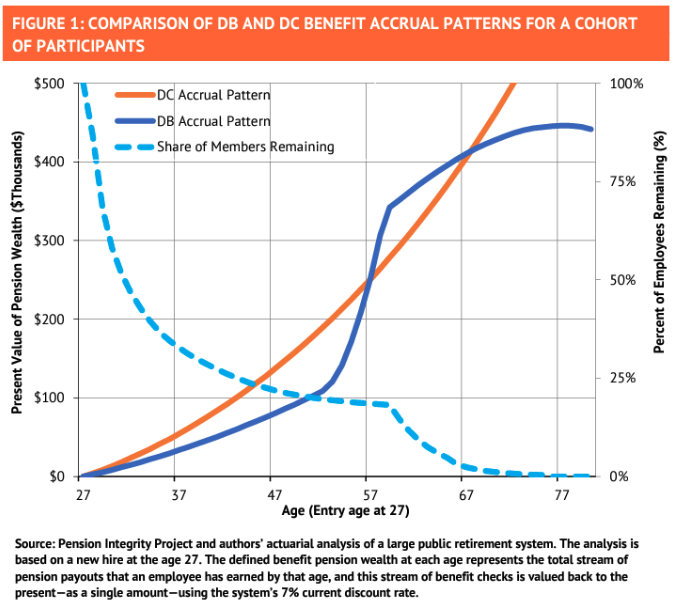

Each month, we feature a pension-related chart or infographic of interest generated by our team of analysts. This month, Reason Foundation’s Rod Crane illustrates how long vesting periods and the back-loading nature of traditional defined benefit plans benefit long-term employees but disadvantage those with shorter tenures. In most cases, the defined contribution benefit accruals exceed defined benefit pension benefit accruals until an employee reaches over two decades of service. The full analysis is available here.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.