Newly released forecasting by the Pension Integrity Project indicates that state pension systems will likely remain at historically high debt levels. Based on an estimated annual investment return of 7% for public pension plans, Reason Foundation forecasts the 118 state pension systems analyzed have $1.3 trillion in total unfunded liabilities at the end of the 2023 fiscal year.

The table below is a snapshot of the forecasted 2023 unfunded accrued liabilities and funded ratios, organized by state, using a 7% return assumption for 2023. The table also presents the projected unfunded liabilities and funded ratios for each state under 5% and 9% investment return scenarios to give a range of potential investment return outcomes.

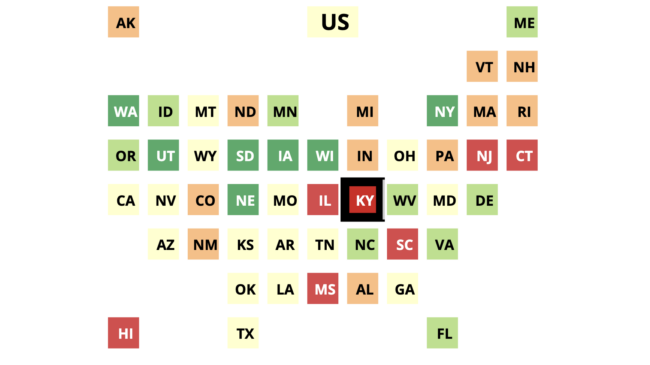

Assuming a 7% return for the 2023 fiscal year, on a funded ratio basis, the state with the best pension funding is Washington, which sits at around 107% funded and has a surplus of $8 billion. New York is the other state project to have a surplus ($8.7 billion) at the end of 2023.

The other 48 states are projected to have public pension debt after their 2023 fiscal years. California has the largest amount of unfunded public pension liabilities, estimated at $245 billion after the 2023 fiscal year. Illinois and New Jersey are also forecast to have over $100 billion in unfunded liabilities at the end of 2023, followed by Texas with over $88 billion in public pension debt.

In terms of funded rations, a pension plan’s assets as a percentage of its liabilities, the lowest-funded state is Kentucky. Its public pensions are just 47% funded, with unfunded liabilities of $44 billion. New Jersey is the other state with a funded ratio under 50%, meaning it has less than half of the funding needed to pay for promised pension benefits.

In aggregate, state pension plans have reported mostly steady growth in unfunded obligations since the Great Recession of 2007-2009. In 2020, 2022, and now 2023, total state pension debt amounts were around the current level of $1.3 trillion, the highest total state pension debt ever seen.

Funded ratios have improved gradually over that time—but very slowly. State pension plans' funded ratios hit a low of 63.5% funded in 2009 and are projected to be 76% funded after their 2023 fiscal years. This means that after 15 years of trying to recover from massive financial losses suffered in 2008 and 2009, state pension plans can only pay 76 cents of every dollar of retirement promises already made to teachers, police officers, firefighters, and other public workers.

Only a few state-run pensions have reported their investment returns for the 2023 fiscal year. The 2023 investment returns that have been publicly released suggest a mixed set of results hovering above and below the nationwide average investment return assumption of 7%.

Of the plans reporting investment results as of this writing, the best investment returns are from the Louisiana State Employees' Retirement System, with an 11.7% return for 2023, and the Oklahoma Public Employees Retirement System, with a 10.9% return for 2023.

The lowest, or worst, investment returns reported so far are from the Indiana Public Retirement System, with a 2.2% investment return for 2023, and the Oklahoma Police Pension and Retirement System, with a 2.9% return for 2023.

The State Pension Tracker dashboard allows users to select an investment return rate for 2023 to display how that result would affect public pension funding at a national, state, and plan-specific level.

The tool gives a valuable historical perspective on the funding progress of 118 state-run pension systems. As states gradually report their 2023 investment returns and eventually report their realized unfunded liabilities throughout the year, the dashboard will update to reflect these developments, making the State Pension Tracker a valuable source for fast, accurate, and up-to-date pension analysis.

Public pension funding is deeply influenced by annual investment returns, given that pensions are funded through employer and employee contributions and the investments made using those contributions. Investment returns are inherently volatile. They can fluctuate based on a wide range of economic factors, including market trends, inflation rates, and broader economic health. In years with substantial investment returns, pension funds can see their funded statuses improve, reducing the pressure on employers and governments to make up for any shortfalls through increased contributions. Conversely, in years with poor investment performance, the funded ratio can decline along with rising unfunded liabilities.

Therefore, achieving consistent and positive investment returns is crucial for pension funds' long-term health and stability. Pension plan administrators aim to mitigate risks through diverse investment portfolios and asset allocation strategies that can weather market fluctuations and generate steady returns. However, the continued growth of unfunded liabilities has necessitated urgent and sustained interventions such as increased contributions, adjustments to benefit structures, and potentially, going forward, the exploration of more conservative investment expectations to mitigate future risks and ensure that pension promises made to public workers are kept.

Click here or on the dashboard preview below to explore the full State Pension Tracker.

For any questions about the State Pension Tracker or this analysis, please email Zachary Christensen at zachary.christensen@reason.org.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.