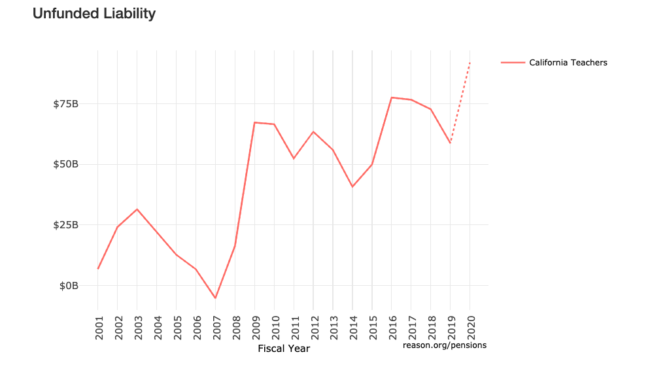

Before the coronavirus pandemic, state pension debt was already over $1 trillion nationally and growing. Although the long-term effects of the pandemic and economic downturn are unclear, initial estimates from the Pension Integrity Project at Reason Foundation suggest that state public pension plans could see their unfunded liabilities skyrocket to between $1.5 trillion and $2 trillion, depending on investment returns at the end of the current fiscal year.

Most of the nation’s teachers and other K-12 educational employees are members of their state’s public pension plans. After years of service to the community, these plans have promised a secure retirement for educators and support staff. Unfortunately, a significant number of public pension plans that serve these employees were severely underfunded before the pandemic and will likely be pushed further into debt this year due to poor plan assumptions and the economic downturn. This pension debt not only takes funding away from classrooms but could also put future benefits and pay increases in jeopardy.

As states prepare to face mounting budget challenges, this tool can help you understand what impact the coronavirus pandemic and economic crisis may have on public pension plans serving active and retired educators.

In the tool below, choose a public pension plan and the investment return rate to see how that plan’s unfunded liabilities and funded ratios may be impacted by volatile market conditions.

We recommend viewing this interactive chart on a desktop for the best user experience. If you are having trouble viewing the chart and interactive options on your device, please find a mobile-friendly version here.

Please note that the interactive tool will automatically sleep after a certain idle and can be restarted by simply refreshing the page.

To examine the impact the current market volatility and coronavirus pandemic may have on all public pension plans that service state employees—beyond educators—please visit this page.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.