Low-income students face unique educational challenges their non-economically disadvantaged peers do not. Consequently, researchers advise that state school finance formulas direct greater resources to low-income students to reflect the higher costs of serving them. However, while most state education funding systems include features that direct greater resources to low-income students, states vary substantially in how much additional funding they allocate to low-income students, how the funds are delivered, and how they identify poor students. The purpose of this column is to survey current funding methods different states employ to support low-income students and to highlight best practices for policymakers looking to optimize their state school finance systems for all students.

Current State Poverty Funding Practices

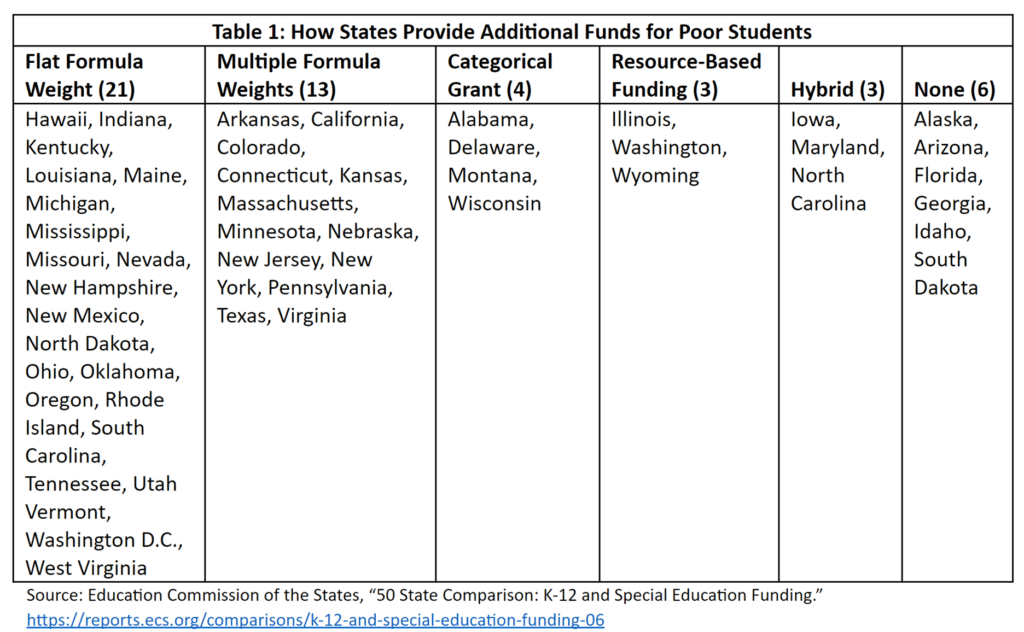

44 states and the District of Columbia have funding mechanisms that direct additional funds to low-income public-school students. Most of these states feature weights in their school funding formulas that direct additional dollars to poor students. Weights are usually a multiplier applied to a per-pupil dollar amount in the state formula that proportionally increases the amount of funding a high-need student receives in relation to the funding received by non-high need students. Some states use flat weights that apply equally to all low-income students while other states use multiple weights directing greater resources to districts with higher concentrations of poverty. Alternatively, other states support poor students through separate categorical grants outside of their main funding system, by allocating additional staff for low-income students (i.e. resource-based funding), or by combining several different approaches at once (i.e. hybrid). Finally, a minority of states feature no additional funding for poor students in their school funding formulas. Table 1 summarizes this information.

Readers should be aware that Table 1 doesn’t fully capture the distinctive features of each state’s poverty funding regime. For instance, while many states with flat weights apply a multiplier to a base per-pupil funding amount (Michigan, South Carolina), some states identified in Table 1 as having a flat weight have policies specifying dollar amounts, not formalized weight multipliers (Ohio, Tennessee). Nonetheless, these states are classified together because their methods are similar in practice.

States also vary widely in the magnitude of additional resources they provide for poor students. States using flat weights often have multipliers within a range of 15-30 percent of their per-pupil base amount (e.g. Kentucky, Louisiana, Maine, Missouri, New Mexico, Oklahoma, Oregon, and more). However, there are also outliers on either end. Nevada has a very modest weight of only 3 percent of the state’s per-pupil funding amount while Maryland features a very generous weight of 91 percent—in addition to a categorical grant for districts with high concentrations of low-income students.

Another important difference between states is how they count low-income students. The most common metric states use to identify low-income students is eligibility for free and reduced-price lunch under the National School Lunch Program (NSLP). 35 states identify poor students using free and reduced-price lunch eligibility—with 19 of those relying exclusively on that metric. Four others identify students as low-income only if they qualify for free lunch under the NSLP. The remaining states that direct additional resources to low-income students rely solely on federal Title I program eligibility, child poverty rate estimates from the U.S. Census Bureau, or direct certification. In states using direct certification, school districts identify low-income students that are already participants in other federal means-tested programs such as the Supplemental Nutrition Assistance Program, Temporary Assistance for Needy Families, and foster care.

Recommendations for States Considering Reform

While it’s helpful for states considering improvements to their school finance systems to be aware of what other states are doing, it’s also important for policymakers to recognize that each state is different and every funding strategy for low-income students will have trade-offs. Here are some important principles for policymakers to keep in mind when considering reforms to how they support low-income students:

- States must count low-income students accurately. This principle may seem straightforward, but one of the most pervasive problems in state K-12 education poverty funding mechanisms is that student counts are inaccurate. The most common reason for this issue is the continued use of free and reduced-price lunch eligibility under the NSLP in many states. Recent changes to NSLP policies aimed at alleviating administrative burdens at high-poverty schools have made it so that many students qualifying for free or reduced-price lunches are not themselves low-income. Evidence from Massachusetts indicates that the overcounting of low-income students using NSLP eligibility could be substantial. When Massachusetts moved away from NSLP as a proxy for poverty and adopted direct certification in 2014, the share of students identified as low-income decreased by 31.4 percent. Other states should follow suit and adopt direct certification to ensure that they are prioritizing school resources for the highest-need students.

- There is no one correct weight. While researchers have devoted significant attention to the question of how much funding low-income students need in order to perform on par with their non-poor peers, there is no decisive answer. States should prioritize public resources for low-income students, but the magnitude of additional funding that should be devoted to poor students will vary based on resource constraints and other factors. A good first step for states considering reform could be to compare how their additional poverty funding compares to that of other states.

- It’s most important to evaluate the fairness of funding systems in their entirety. While it may seem reasonable to assume that states with higher poverty weights would distribute greater funds to their highest-need school districts overall, that’s not necessarily the case. Other factors such as district property wealth or state reliance on categorical grants outside of its main funding formula can play a far more important role in determining funding distributions. For instance, one popular analysis on school funding fairness from the Education Law Center that assigns grades to state K-12 funding systems gives Maryland a “D” on its distribution of funds while assigning Florida a “C.” In other words the report finds that Florida distributes its funds more progressively than Maryland does. This is remarkable, considering that Maryland has a very generous poverty weight of 0.91 while Florida has no poverty weight at all.

- Ensure dollars are reaching the intended students. Much of the research on the fairness of state K-12 funding systems focuses on how dollars are delivered to school districts. However, analyses shouldn’t stop at that point. A final and equally important step in education resource distribution is how districts deliver funds to individual schools—and research suggests that improvements to how states fund school districts don’t necessarily lead to improvements in the level of resources reaching high-need students. This is because districts usually allocate resources to schools as staffing and program allotments that don’t primarily factor in resource equity for individual students at each school. Therefore, reforms to how states allocate funds to districts must be complemented by reforms in how districts allocate funds to schools.

- Ensure local leaders have flexibility over how funds are used. Top-down state restrictions on how education funds are used fail to leverage the knowledge that local education leaders have of their students’ needs. No uniform spending strategy yields consistent results across different school districts and schools.

- Make funding mechanisms transparent and easy to understand. Many states have complex funding systems that don’t have a coherent overall strategy. This is a problem because it prevents families and local education leaders from easily evaluating the fairness and effectiveness of the state’s funding system.