-

How drug decriminalization affects policing

With the diminished capacity and incentive to pursue drug possession arrests, police can redirect resources toward crimes with victims, crime prevention, and public safety.

-

Best practices for pension debt amortization

Amortization policy is at the core of the successful elimination of pension debt.

-

Best practices in hybrid retirement plan design

The recent shift toward offering hybrid plans to newly hired government employees suggests that governmental employers may be changing their perceptions of the balance of financial risk between employees and employers.

-

Modernizing the passenger facility charge to improve aviation

Modernizing the passenger facility charge would improve airports and increase airline competition.

-

The impact of cash flow on public pensions

This policy brief uses the Montana Public Employee Retirement System (PERS) as a case study to illustrate the principles and importance of conducting a cash flow analysis of public pension plans.

-

How to reform the FDA

Reimagining pharmaceutical regulation, so it better serves society’s needs by encouraging widespread availability of life-saving drugs at lower prices.

-

Frequently asked questions on public school open enrollment

Public school open enrollment policies allow students to transfer to the public school of their choice.

-

Testing mileage-based user fees as a replacement for Georgia’s gas tax

Georgia’s highways need a new, sustainable funding source.

-

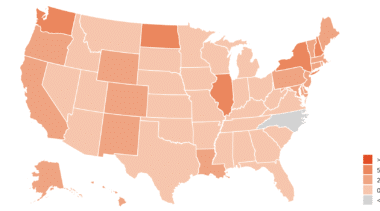

K-12 Education Spending Spotlight: An in-depth look at school finance data and trends

Reason Foundation’s new K-12 Education Spending Spotlight provides critical insight into key school finance trends across the country.

-

Best practices for cost-of-living adjustment designs in public pension systems

Striking the proper balance between cost, risk, and benefits in a way that works for both employees and employers.

-

Frequently asked questions on student-centered funding

Student-centered funding puts student needs as the focus of education funding decisions.

-

Converting high occupancy vehicle lanes to high occupancy toll lanes or express toll lanes

This brief examines why and how high-occupancy vehicle lanes are converted, how much the conversions cost, and how high-occupancy toll and express toll lanes have performed.

-

How to improve transit service for today’s workers and commuters

U.S. metro areas need a new transit approach that is tailored to serving the needs of today’s workers.

-

How Washington state can transition from the gas tax to road usage charges

This brief suggests a policy framework for developing a road usage charge program in Washington and an implementation order that builds on systems already in place on the state’s major highways.

-

Examining the Teachers Retirement System of Texas after the pension reforms of 2019

Senate Bill 12 of 2019 made reforms, but TRS contributions will likely be insufficient because the pension plan is using outdated economic assumptions.

-

Replacing Michigan’s gas tax with mileage-based user fees

A transition from per-gallon fuel taxes to a mileage-based user fee system should be considered as a strategy to ensure adequate road funding for Michigan’s future.

-

What is a revenue-risk public-private partnership?

And when is revenue risk the better financing choice for the state and taxpayers?

-

The impact of California’s cannabis taxes on participation within the legal market

This analysis develops an empirical model to estimate the degree to which California’s tax regime affects participation within its commercial cannabis market, and how participation may change through different approaches to taxation.