-

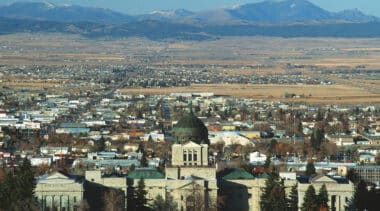

Montana’s default retirement benefit option should best serve most public workers

Montana House Bill 226 would better align the default retirement benefit option with what would best most workers need.

-

Updated Arizona K-12 education finance model with latest school finance and transportation data

The model allows users to test changes to Arizona’s funding formula, see how changes to local property taxes impact funding, and see how potential changes affect the funding of individual school districts and charter schools.

-

Airline deregulation: Past experience and future reforms

The U.S. experience with airline deregulation shows that eliminating government barriers to competition can generate enormous benefits for consumers.

-

Preserving and expanding the benefits of airline deregulation

Three reforms Congress could make to expand the benefits of airline deregulation.

-

Automated vehicle policy recommendations for the 118th Congress

The future of automated driving systems and how to refocus federal policymaking on productive near-term activities.

-

Why New Mexico House Bill 547’s tax increases undermine public health

The taxes in the bill would hurt efforts to reduce the smoking of traditional cigarettes and disproportionately harm low-income families.

-

Montana reform would improve pension funding and retirement savings for public employees

Montana House Bill 226 would adopt actuarially determined employer contributions funding to guarantee benefits are fully funded within a specified timeframe.

-

Tolling value proposition for trucking and state departments of transportation

The question addressed in this paper is whether toll-financed interstate highway modernization could overcome the long-standing objections of the trucking industry, as well as concerns of state DOTs about the coming decline in fuel tax revenues.

-

The current status of Texas Central’s proposed high-speed rail line linking Dallas and Houston

The high-speed rail vision Texas Central outlined in 2013 of easy land acquisition, quick construction, minimal opposition, and low costs is vastly different from the grim reality that caused the company to abandon its project in 2022.

-

Clearing up definitions of backpack funding

Without strong funding portability mechanisms, school districts have weak financial incentives to welcome transfer students.

-

Modeling methodology and approach to analysis of public retirement systems

The Pension Integrity Project uses custom-built actuarial and employee benefit models that are tailored to reflect each unique retirement system.

-

Alaska House Bill 28 would help provide justice for those harmed by marijuana prohibition

Alaska lags behind other states when it comes to mitigating the harms done by marijuana prohibition.

-

State policy agenda for telehealth innovation

This report examines all 50 states in four key areas where there's an opportunity to maximize the potential of telehealth services.

-

Pension changes in House Bill 22 and Senate Bill 35 threaten Alaska’s budgets

HB 22 and SB 35 could cost Alaska upwards of $800 million in the coming decades.

-

K-12 open enrollment in Wisconsin: Key lessons for other states

Wisconsin's public school open enrollment program serves over 70,000 students and can be a model for other states.

-

Scrutinizing NDPERS’ cost claims on House Bill 1040

NDPERS is choosing to adopt the costliest interpretation of HB 1040 and is cherry-picking the worst from a range of actuarial cost estimates to scare away proponents.