North Dakota Gov. Doug Burgum just signed into law House Bill 1040 (HB 1040), major new reform legislation that will put North Dakota’s underfunded defined benefit pension system for public employees on a path to financial solvency. HB 1040 meaningfully addresses the current plan’s perpetually rising pension debt by upgrading to an improved pension funding policy.

At the same time, the bill will remove taxpayer-borne financial risk over time by entering all public employees hired after January 1, 2024, into the state’s defined contribution retirement plan—a quality retirement plan design currently in place, with no risk of generating future unfunded liabilities. In concert, the reform will close the current NDPERS defined benefit pension system to new entrants.

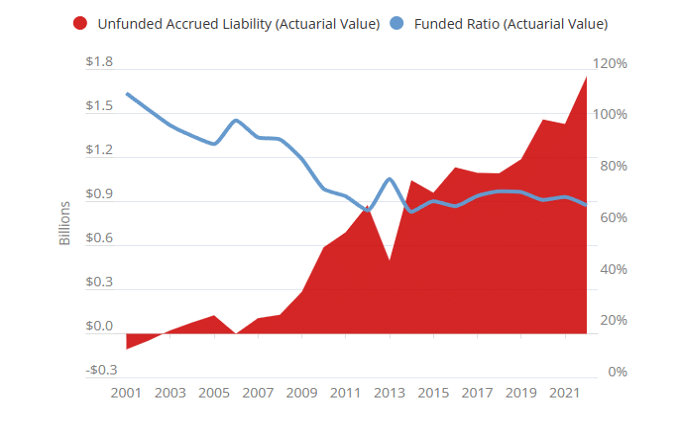

The need for these pension reforms came about because the North Dakota Public Employees Retirement System, NDPERS, has accumulated $1.8 billion in unfunded liabilities over the past 16 years (see Figure 1). The pension system stands at only 67% funded today, maintains a funding policy that has been structurally underfunding the plan for more than a decade and was projected to go completely insolvent over the next several decades absent significant changes.

Figure 1. Rising Public Pension Debt and Decreasing Funded Ratio

Source: Reason Foundation analysis of North Dakota Public Employees Retirement System actuarial valuations.

Prior to North Dakota’s 2023 legislative session, Reason Foundation operated as pro-bono technical assistants for a state interim retirement committee created under House Bill 1209 during the 2021 legislative session. The committee was charged with studying how to effectively close the current NDPERS defined benefit system and move to an alternative pension plan design. The Pension Integrity Project built an actuarial model for NDPERS to forecast projected costs and risks under a variety of scenarios and made four presentations to the interim committee, detailing our views on effective plan design, transition costs, and benefit modeling. We also provided input and language for the final bill passed by the interim committee.

During the legislative session, we served as technical advisors throughout the legislature’s deliberations on HB 1040, publishing multiple one-pagers explaining the bill, producing scorecards comparing the current offerings to our best practices, and presenting in-person testimony for both the House and Senate’s relevant policy committees. We also presented to both the House and Senate majority caucuses to answer questions about costs and policy considerations.

North Dakota’s Need for Public Pension Reform

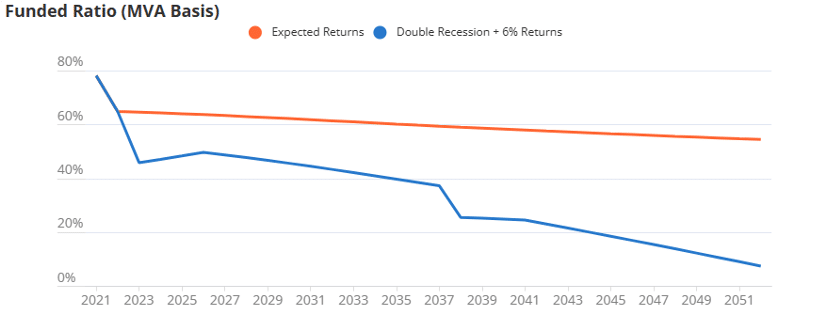

Without any changes to the pension system, NDPERS would have continued to accrue unfunded liabilities, ultimately exhausting its assets in approximately 80 years—if everything went as the plan expects. If market returns fell below what the plan expected, its assets could have been depleted in as little as 35 years (see Figure 2).

Figure 2: NDPERS Status Quo—Funded Ratio Forecast

Source: Reason Foundation modeling of NDPERS

The deterioration of NDPERS’ financial health over the past 16 years has led to previous efforts to shore up the system through incrementally increased contribution rates. However, these incremental adjustments were too small and insufficient to meaningfully improve the pension system’s overall solvency. Accordingly, the rates required to begin properly funding the pension plan were never close to being reached, and it became clear that a larger reform was needed to infuse more money into the plan.

While the cost of offering this particular defined benefit pension should be low—the NDPERS benefit formula is one of the least generous among all U.S. public pensions—it was saddled with years of underpaid contributions and high interest rates on the pension system’s accruing debt. Those two factors were the lion’s share of the reason that NDPERS moved from being overfunded in the year 2000 to $1.8 billion in debt in 2022.

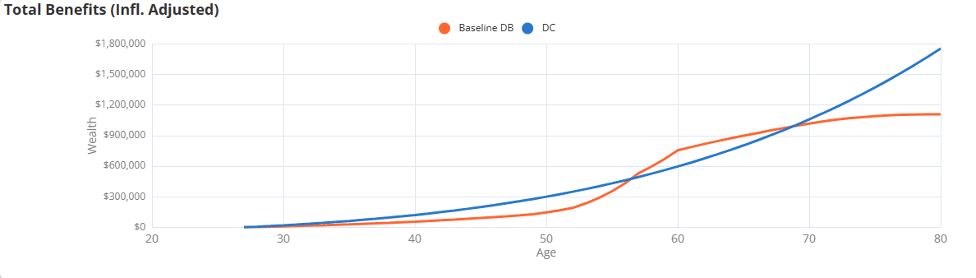

Apart from its poor finances, the NDPERS defined benefit plan was also experiencing massive amounts of employee turnover. It became clear to most observers that offering a more portable retirement plan option would greatly enhance the workers of North Dakota’s overall retirement savings. When studying different options, it also stood out that the pension plan being offered to NDPERS employees was the least generous statewide plan in the country. Not only would a new employee need to work for more than 30 years in the pension system to receive a greater benefit than the defined contribution plan that will be offered to new hires under HB 1040, but any swap to a different funding method would saddle new employees with helping to pay down older employees’ pension debts.

Figure 3: Employee Benefit Comparison—Status Quo NDPERS Pension vs. HB 1040 DC Plan

Source: Reason Foundation benefit modeling for NDPERS current pension plan vs. the proposed defined contribution plan in HB 1040.

Goals of North Dakota’s Public Pension Reform

The NDPERS reform effort sought to establish a retirement system that is affordable, sustainable, and secure. Consistent with the Pension Integrity Project’s overall retirement policy goals, the primary goals of North Dakota’s reform included:

- Keeping Promises to Workers: Ensure the ability to pay 100% of the retirement benefits earned and accrued by active workers and retirees.

- Retirement Security: Provide retirement security for all current and future employees.

- Predictability: Stabilize contribution rates for the long term.

- Risk Reduction: Reduce the pension system’s exposure to financial risk and market volatility.

- Affordability: Reduce the long-term costs for employers, taxpayers and employees.

- Attractive Retirement Benefits: The plan should meet the needs of workers and help agencies recruit and retain employees.

Overview of North Dakota’s Pension Reform

First and most importantly, House Bill 1040 fixed the systematic underfunding that NDPERS has suffered over the past two decades by swapping from contribution rates set in statute to an “actuarially determined employer contribution” rate, or ADEC rate for short. ADEC is a calculation performed by professional actuaries during the pension valuation process that shows what plan contribution rates need to be to pay for both benefits and debt service costs.

The pension benefits promised to members of NDPERS are ultimately the responsibility of the state and local governments—i.e., taxpayers. Continuing to fall short of fully funding these pension promises unfairly passes on the cost of today’s public services to future generations.

Second, this bill closes the current structurally underfunded defined benefit plan to all future new hires and instead offers them a defined contribution retirement plan that our analysis finds meets the high standards of best practices in retirement system design. The reform signed avoids the accrual of new unfunded liabilities related to future hires and would, in 90% of cases, offer a more generous retirement benefit to newly hired workers than the current NDPERS pension no matter when they leave or retire.

To help visualize the thought process behind this reform, think of NDPERS’ unfunded liabilities as an oil spill. The two most urgent actions are: (1) to cap the spill; and (2) to clean up the oil that’s spilled already. The transition to the defined contribution plan for future hires caps the spill because no new hire would ever have the risk of an unfunded pension liability attached to them in the future. The second course of action is to clean up the oil already spilled, which is what the shift to proper actuarial funding does. Over the next 30 years, the state and, on a much smaller scale, its local governments, should be able to pay off the pension system’s existing $1.8 billion in debt by making full actuarial contributions to the NDPERS defined benefit plan.

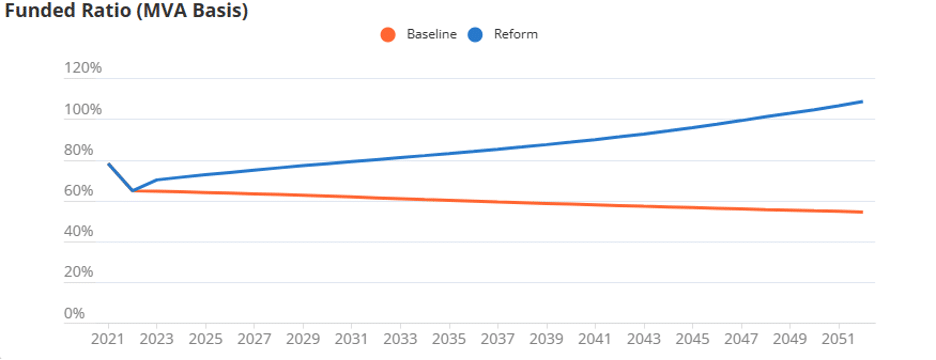

To assist that paydown, the state has also put other cash infusions into this bill, which will be paid every biennium until the defined benefit plan reaches 90% funding. Our modeling forecasts show that these added funds, coupled with the swap to a proper actuarial funding method, would save North Dakota $2 billion dollars over the next 30 years relative to the status quo and finally put NDPERS back on proper financial footing (see Figure 4).

Figure 4: NDPERS Funded Ratio Trajectory, Current Plan vs. HB 1040 Reforms

Source: Reason Foundation modeling of HB 1040 reforms and NDPERS actuarial valuations.

Expected Effects of the Pension Reform

Overall, North Dakota’s important pension reform will yield several key benefits to taxpayers, employers, and NDPERS employees:

- For the 91% of all newly hired state and local government employees who will not stay in their NDPERS-covered employment jobs for 30 years, they will receive better retirement benefits than the current defined benefit pension plan offers.

- Swapping to ADEC funding ensures the already accrued pension debt will finally begin to be paid off, saving the state billions of dollars in added debt and interest costs over the next 30-50 years.

- Once NDPERS becomes fully funded, contributions to the plan will drop drastically. This allows for more space in the state budget to fund other programs and positions, or provide tax relief to the citizens of North Dakota.

Conclusion

The passage of HB 1040 is the state making an overdue commitment to fully pay for the retirement benefits it has already promised generations of public workers and retirees of North Dakota, who understandably expect to have the pensions promised to them adequately funded. The bill also protects taxpayers by preventing future public pension debt and provides future hires with a modern, flexible retirement plan that better meets their needs.

Additional Reason resources on NDPERS reform

- Testimony: North Dakota’s HB 1040 would address many challenges facing NDPERS (reason.org)

- One-pager: Benefits of reform: North Dakota’s HB 1040 would address many challenges facing NDPERS

- Analysis: Does HB1040 meet objectives for good reform?: Does North Dakota House Bill 1040 meet the objectives for good pension reform?

- Analysis: Does the defined contribution plan established in HB 1040 meet gold standards?

- Analysis: North Dakota Public Employees Retirement System Pension Solvency Analysis

- Addressing pushback from reform opponents: Scrutinizing NDPERS’ cost claims on House Bill 1040

Update: May 1, 2023: Included in the North Dakota Office of State Management budget, the defined contribution plan for new hires now begins Jan. 1, 2024. The previous version of this piece stated the new hire date as Jan. 1, 2025.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.