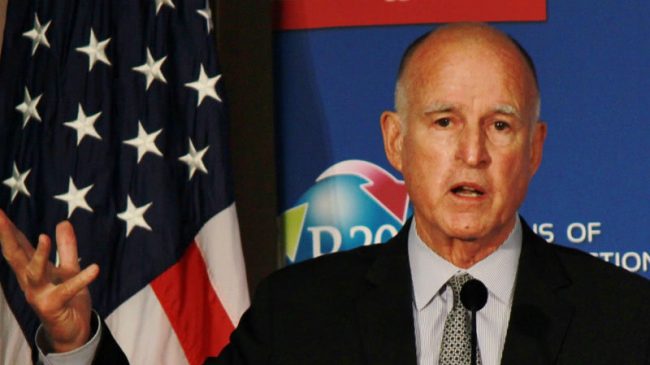

Proposition 30: Governor Brown’s Temporary Sales and Income Tax Increase

Proposition 30 is a state constitutional amendment that would temporarily increase state taxes in order to raise an additional $6 to $9 billion each year for state government. The state sales tax for all Californians would increase to 7.5% for four years. New income taxes would be imposed on wealthier Californians for seven years.

Fiscal Impact

The Legislative Analyst’s Office estimates the tax increases in Proposition 30 would generate additional state revenues of about $6 billion annually from 2012-13 through 2016-17. Smaller amounts of additional revenue would be available in the current year and in 2017-19.

Arguments for Proposition 30

Supporters of Prop. 30 argue that school funding has been cut over several years now and that many teachers have been laid off. The current budget calls for nearly $6 billion in cuts to school spending in the coming year if Prop. 30 does not pass, leading to tuition hikes and more teacher layoffs. If it does pass it will help balance the budget, and that $6 billion will be spent on smaller class sizes, up-to-date textbooks and rehiring teachers.

They also argue that some Prop. 30 tax revenues go to guaranteed public safety funding (the State Constitution prevents the legislature from spending the money on other things). This, they say, will help keep cops on the street.

Supporters defend the idea of tax increases, arguing they are temporary, balanced and necessary. That funding is needed for schools and public safety. Moreover, the Prop. 30 temporary increases in personal income taxes only effect the highest earners, and this temporary sales tax increase is smaller than the one by the legislature that expired last year. So people won’t be paying more sales tax next year than they were last year. In fact, sales tax will be at a rate lower than it was last year.

The money will be protected from politics, according to supporters, with all funds placed in a dedicated account that the legislature cannot touch and which is audited every year to ensure the money is spent on education and public safety.

Key Supporters of Proposition 30

Website: http://yesonprop30.com/

- Gov. Jerry Brown

- League of Women Voters of California California Democratic Party

- California Teachers Association

- California State Council of Service Employees (SEIU)

- California School Employees Association (CSEA)

- American Federation of Teachers (AFT)

- California Federation of Teachers (CFT)

Largest Donors to Yes Campaign as of October 1, 2012

- California Teachers Association: $7,739,080

- American Federation of Teachers: $3,858,700

- SEIU/California State Council of Service Employees: $6,471,858

- California Association of Hospitals and Health Systems: $2,000,000

- PACE of California School Employees Association: $1,500,000

- Democratic State Central Committee of California: $1,046,172

- California Nurses Association: $1,003,669

- United Brotherhood of Carpenters: $1,000,000

Arguments Against Proposition 30

Opponents of Proposition 30 argue that it is a massive tax increase that will take as much as $50 billion dollars from state taxpayers over the next seven years. Moreover, they argue that Prop. 30 has three major flaws.

First, they argue that Prop. 30 does not guarantee any new spending on schools because in balancing the budget the state can shift other funds out of the school budget. So what they give to schools in new Prop. 30 funds they can take away from property tax or other funds.

The second flaw, opponents argue, is that Prop. 30 contains no reforms to how state education funds are spent even though research from Pepperdine University has show that up to 50 percent of the money we spend on education in California never gets to the classroom, but is consumed by administration and bureaucracy. They argue that rather than raise taxes, the government needs to fix things so that education money goes to the classroom.

Opponents of Prop. 30 say the third big flaw is the devastating impact it will have on taxpayers, jobs and the economy. They point out that California already has the highest state sales taxes in the country and that sales taxes hit everyone, no matter what their income. Furthermore, the income tax increases will affect many small businesses because many of them pay individual taxes on their earnings, not corporate taxes. Small businesses with more than $250,000 in sales may have to pay up to 30 percent higher taxes.

Opponents argue that those two taxes combined will force families to cut spending and force small businesses to cut jobs or move out of the state, and that this will be devastating to a state economy already facing high unemployment and slow growth.

They also argue that there are thousands of state programs besides education and public safety- many bureaucracies, commissions and boards-that could be cut to avoid tax increases or cutting school budgets. To opponents of Prop. 30, state leaders are simply threatening schools to bully voters into going along with harmful tax increases.

Key Opponents of Proposition 30

Website: http://www.stopprop30.com/

- Howard Jarvis Taxpayers Association

- National Federation of Independent Business California

- Small Business Action Committee

Largest Donors to No Campaign as of October 1, 2012

- Small Business Action Committee: $710,000

- Howard Jarvis Taxpayers Association: $389,220

- Charles B. Johnson: $200,000

- Jerrold Perenchio: $200,000

- Jon Cox: $100,000

- Errotabere, Inc.: $100,000

- George Hume: $100,000

Discussion of Proposition 30

Using threats to cut school funding is an old political trick in California. Californians have shown over the years that they think education spending is a top priority for the state, and sometimes state leaders take advantage of that. Proponents of Prop. 30 are trying to take advantage of the fact that most people are not government budget experts, with a nifty shell game to fool them that the tax increases will increase school funding.

The current state budget basically counts on around $6 billion in new funds from Prop. 30 to go to education. Then lawmakers pull about $6 billion in other funds out of education and spend it elsewhere, mostly to meet state worker pension obligations. They can do the same in every budget year. The fact is that raising taxes by $6 billion with Prop. 30 will not in any way guarantee more funds for education.

It is true that Prop. 98, which was approved by voters years ago to ensure that a percentage of all new state revenue goes to education, should mean that a big chunk of Prop. 30 tax revenue goes to schools. But in the last ten years the state has “deferred” nearly $10 billion of state revenue that was supposed to go to schools under Prop. 98. So even when we think we are voting to tie the government’s hands on how they spend our tax money, they seem to find ways around it. The problem is that Sacramento is not making education a budget priority.

Consider that Gov. Brown himself told the editorial board of the San Francisco Chronicle in March that the competing tax increase, Prop. 38, is bad because it earmarks the money it would raise for education and will therefore do nothing to alleviate California’s overall multibillion-dollar budget deficit. What he is actually saying is that his Prop. 30 tax increase will alleviate the budget deficit, apparently because it is not really earmarked to education.

Voters need to consider the fact that California’s leaders have a spending addiction. If the Prop. 30 tax increases pass, the state will set a record high for total state budget spending in 2012: $142.4 billion, which surpasses the $138 billion from 2007-2008. And even though Californians have repeatedly made it clear that education should be a top priority in the state budget, in a record breaking large budget Sacramento is threatening cuts to education spending. Lawmakers consistently show they want to spend more on things other than education. As well as deferring nearly $10 billion in Prop. 98 funds that were supposed to go to education, they have let general fund spending fall by 11 percent since 2007-2008 to $91 billion, while increasing special fund spending by more than 47 percent over the same period, from $26.7 billion to $39.4 billion. Since Prop. 98 requirements for education spending don’t apply to special funds, this maneuver served to cut education spending. If the general fund shrinks then Proposition 98 revenue for K-12 and community colleges shrinks as well.

In a time of very slow economic recovery, taking billions from consumers and businesses to fuel record-breaking state spending is an incredibly bad idea. Tax increases are no way to grow jobs and the economy. Moreover, state tax revenue is already about $3 billion short of what the Brown administration projected in June. For several years in a row the state budget has overestimated how much tax revenue will come in, and how much more will be brought in by higher taxes. That is because high taxes compared to other states are making California less competitive and are depressing the state economy.

Spectrum Locations Consultants (SLC) recorded that 254 California companies moved some or all of their work and jobs out of state in 2011, 26% more than in 2010. SLC President Joe Vranich considers California the worst state in the nation to locate a business and Los Angeles the worst city to start a business. His work with clients has found that leaving Los Angeles for another surrounding county can save businesses 20% of costs. Leaving the state for Texas can save up to 40% of costs.

Finally, since education spending has become the rhetorical lynchpin of Prop. 30, voters need to consider if they want more of their money to go into a system that refuses to reform, and where increases in spending are overwhelmingly being consumed by administration, not going to teachers and classrooms and instruction.

The latest analysis of state K-12 education spending by Pepperdine University’s Davenport Institute is pretty damning. The percentage of funding going to direct classroom expenditures has been falling. Less than 50 percent goes to teacher salaries and benefits. Per student spending on administrators grew twice as fast as spending on teachers. Indeed, spending on staff travel and conferences grew faster than spending on teacher salaries!

The story is equally bad in higher education. Salaries in student services and institutional support have grown twice as fast as instructor’s salaries. Worse, from 1994-2009 University of California faculty increased 33 percent, while the number of senior managers increased 194 percent. There are now more managers at the University of California than faculty.

Tax increases right now will hurt taxpayers, stunt job growth, and feed Sacramento’s spending addiction. Additional education funding will only continue to feed bad decisions to invest more in administration and managers than in classrooms and instruction.

Propositions

- Proposition 30: Governor Brown’s Temporary Sales and Income Tax Increase

- Proposition 31: State Budget and Funding Reforms

- Proposition 32: Restrictions on Union and Corporate Campaign Contributions and Payroll Deductions for Political Funding

- Proposition 33: Auto Insurance Based on Driver’s History of Insurance Coverage

- Proposition 34: Replace Death Penalty with Life in Prison

- Proposition 35: Increased Punishment for Human Trafficking

- Proposition 36: Reform of Three Strikes Law

- Proposition 37: Labeling of Genetically Engineered Foods

- Proposition 38: Tax Increase for School Funding

- Proposition 39: Tax Increase on Multistate Businesses and Funding Clean Energy

- Proposition 40: Redistricting State Senate Districts

This Study’s Materials

- California Voters Guide 2012, PDF, 241.8 KB

Adrian Moore