As we highlighted in our July 2016 newsletter, a recent Rockefeller Institute simulation project has found that while common funding policies and practices of public sector retirement systems are effective at reducing year-to-year contribution rate volatility, there is a troublesome flip side to the equation: common funding policies are also increasing the likelihood of severe long-term underfunding. This report has been receiving increasing attention and it is worth discussing the findings in more detail.

The Rockefeller study, conducted by Donald J. Boyd and Yimeng Yin, found that by implementing funding policies designed to produce low year-to-year contribution volatility—such as 30-year, level-percent, “open” amortization methods—plan sponsors can generally enjoy lower initial payments. This can be quite attractive to governments that sponsor public pension plans, as the lower initial payments allow them to keep taxes lower or services higher in the early years after investment shortfalls. However, as could be inferred, low initial payments come at the expense of greater contribution payments later, as well as greater tax and service trade-offs in the following years.

The stochastic model used in the study simulates possible future outcomes of a standard 75% funded pension plan and calculates annual finances by running many sets of investment returns assuming a 7.5% compound average return and 12% standard deviation.[1]

All in all, the simulation results indicate that these funding policies are unlikely to bring underfunded plans to fully funded status within the first 30 years, even if investment-return assumptions are met every single year and employers make their full actuarially determined contributions. For example, the same pension plan that uses a common policy of 30-year, level-percent, open amortization method, was found to reach only 85% funded status after 30 years, even if it earned its assumed 7.5% return every single year.

The down side of the open amortization method, as well as inappropriately high discount rate assumptions, is that plans and their sponsors could expose themselves to substantial risk of potential crises.[2] This comes from the fact that in the current low-interest-rate and low-inflation environment, many pension plans are now taking on additional risk of significant investment shortfalls as a way of raising their chances of achieving overly optimistic return assumptions. This means that investment earnings will be particularly volatile, and funding policy takes on greater importance. The same plan was found to face approximately 17% chance of falling below the 40% funded status within the 30-year period if its investment return assumption is correct on average, but has a 12% standard deviation.

Furthermore, the authors point out that if sponsors do not pay full actuarial contributions, or if reasonable expected returns are less than 7.5%, the risk of severe underfunding goes up.

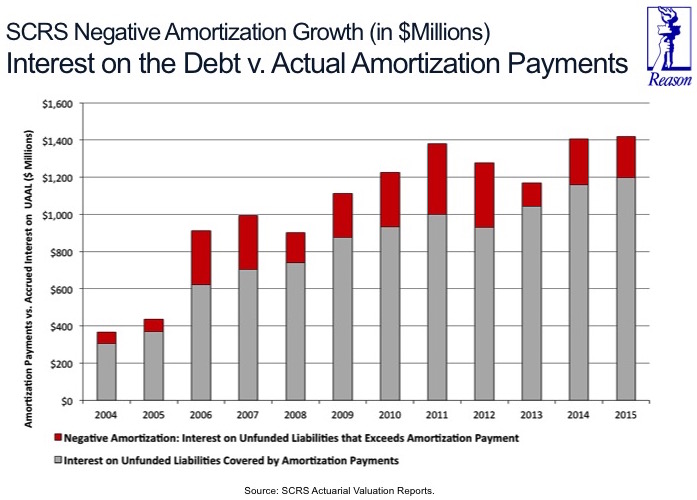

Unfortunately, this is not just a theoretical, academic issue, as the South Carolina Retirement System (SCRS) knows well. SCRS currently uses a 30-year open amortization schedule. Since 2004, amortization payments towards the growing SCRS unfunded liability have always been less than the interest on that pension debt, shown in the below figure.

As would be intuitively suggested by the Rockefeller study, SCRS has seen its unfunded liabilities grown from around $4 billion in 2004 to $19 billion in 2015. The funded ratio has fallen from north of 80% to south of 60%.

According to the Rockefeller study, SCRS is not alone in its practice. Out of 138 state plans reviewed in the study, nearly 40% used open amortization method. Here are some other key findings from the study:

- The open amortization method generally takes the longest to pay down an unfunded liability and tended to be combined with the longest amortization schedules, extending the period to pay down unfunded liabilities.

- The longer the amortization period, the lower the annual payments and the longer it will take to pay off the liability (if ever).

- It is easy to see why the very stretched-out policy of 30-year open-period funding is attractive to employers. Unlike other policies currently used by funds, it was found to have near-zero chance of employer contributions rising above 30% in 30-year period. As a result it provides stability to plan sponsors, but that stability comes at a price – a risk of severe underfunding when investment returns vary from year to year. Replacing open amortization method with closed amortization mehod can considerably improve the long-run funded status at the expense of higher contributions.

- Level dollar methods tend to pay off liabilities more quickly than level-percent methods. When investment returns or other actuarial factors work out better than expected the level-percent method also defers more of the good news than do other methods.

- Closed methods pay down liabilities faster than open methods. In fact, open methods never completely pay down a liability, although the liability may be reduced substantially.

- Liabilities can shrink as a share of payroll as the time horizon lengthens, but only because payroll grows faster than liability and if other assumptions are met. As an example, after 50 years, nominal liability under 30-year, level-percent, “open” amortization method was projected to more than double its initial value and continued to rise, but relative to payroll it constituted just 40% of its original level. Although the burden of amortization contributions falls as a share of payroll, it continues forever and rising in absolute terms.

- All in all, plans that use funding policies with low contribution volatility have much greater likelihood of reaching a very low funded status.

- The effect of employers not paying the full ADEC also appears to be more prominent when the plan faces bad investment return scenarios as the contribution cap triggered more frequently in the model.[3]

All of this raises important policy and budgetary questions for legislators about the effect that pension contributions and various funding policies will have on state and local government taxes and spending in both the near-term and the long-term. For plans that are engaged in the problematic funding policies, the likely solution will mean ending those practices and thus increasing contributions. But given that every government has to consider a wide range of policy concerns, it may not be feasible to change a bad funding policy in the near term. With bad pension funding policy at place there is no easy way out and, as in many cases in public policy, every option has its trade-offs.

To read the full paper, go here.

__________________________

[1] Year-to-year investment returns in the model are assumed to be independent of each other — bad investment years are not necessarily followed by good investment years, and vice versa.

[2] The accounting standard that allowed negative amortization and “open” method was adopted over the dissent of GASB’s then-chairman James F. Antonio in 1994. Antonio expressed concern over the open amortization method being permitted by GASB Statement No. 25 because “the open method, when coupled with an amortization period of 30 to 40 years, produces no perceptible amortization of the unfunded actuarial liability. Although actuaries may consider this to be an amortization method because the unfunded actuarial liability decreases over time as a percentage of payroll, it is not an amortization method in an accounting sense because the liability increases in absolute amount.”

[3] Study simulated ADEC with a 20% cap, where employers make up to 80% of the actuarially determined contribution each year.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.